Permissions

You will require an Access Role with the following permissions:

- Base Information (Expense Items)

- User Management (Employees)

Method 1 - Deduction Before Payment

Method 1 guides you on how to configure Assure Expenses in order to deduct personal mileage from a fuel card claim to ensure only the value of business miles travelled is reimbursed.

- You will need to create two expense items:

- Fuel Card Mileage

- Fuel Card Receipt

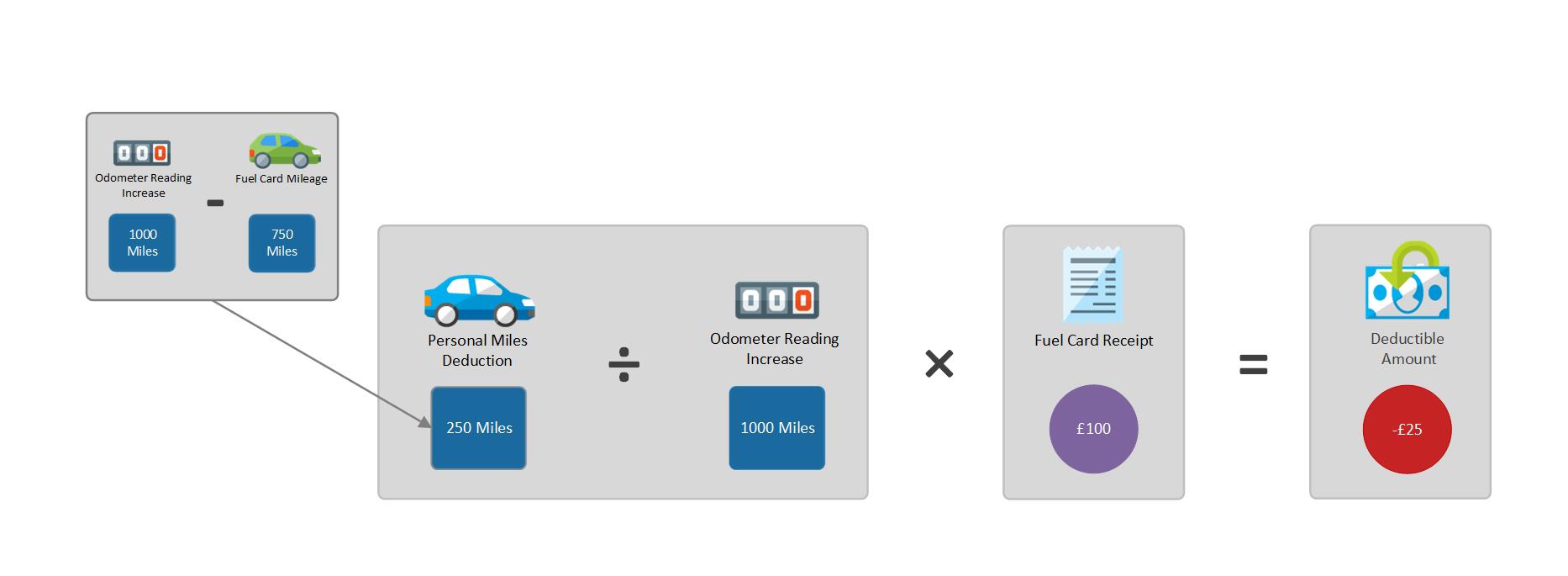

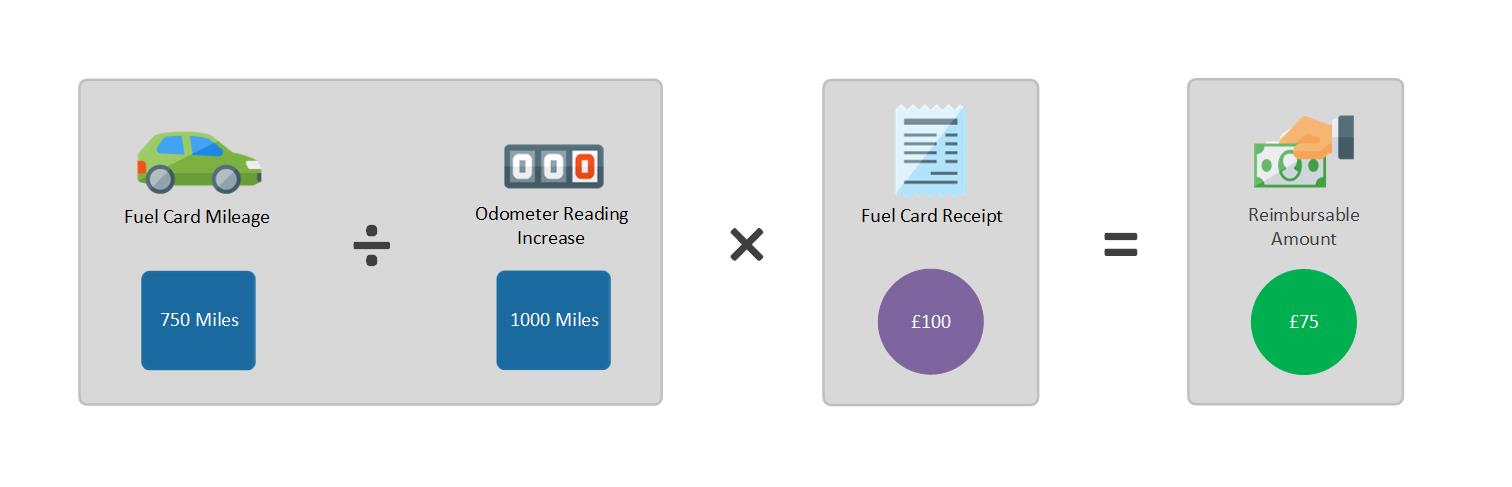

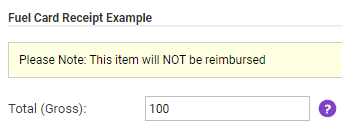

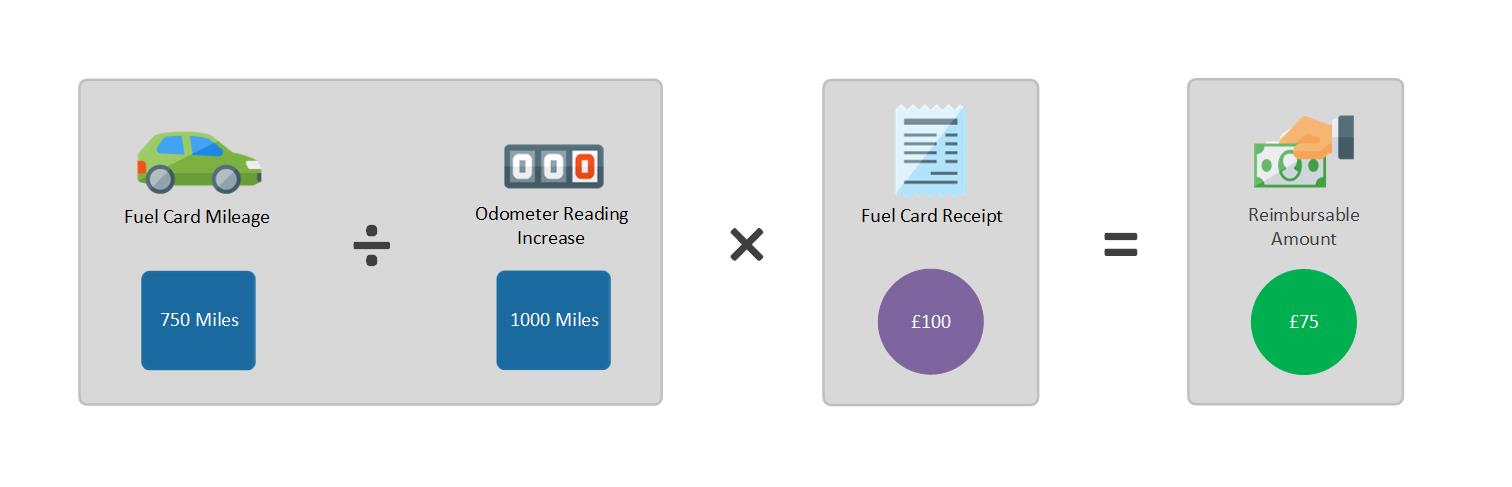

- Vehicle odometer readings must be made mandatory when submitting a claim. This will allow Assure Expenses to calculate the difference between business miles and total miles travelled during the period, in order to reimburse the correct proportion of the fuel card spend that was used for business miles. The diagram below displays an example calculation that would occur after claim submission:

Create Fuel Card Mileage Expense Item

To configure the fuel card mileage expense item, follow the steps below:

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items.

- Click New Expense Item. For more information on creating an expense item, view Create an Expense Item.

- Within the General Details section, ensure the Reimbursable check box is selected.

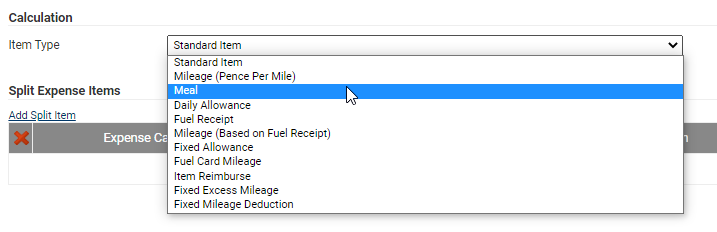

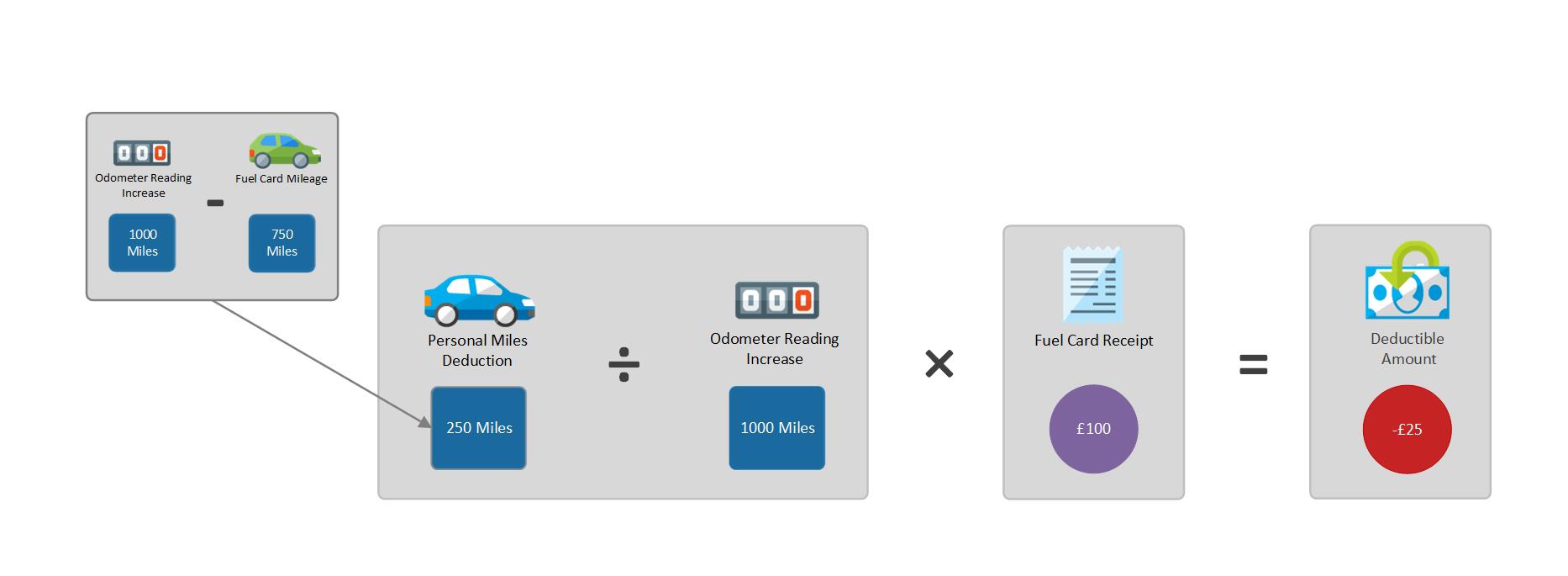

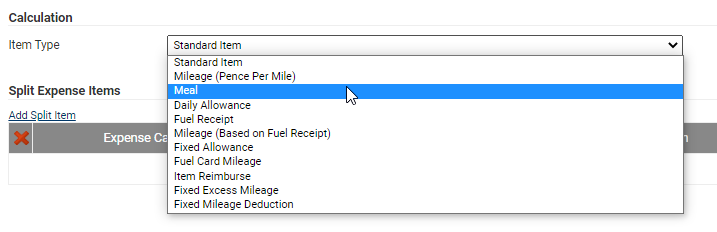

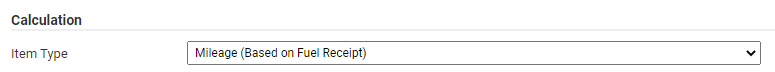

- Ensure that 'Item Type' field is set to Mileage (Based on Fuel Receipt).

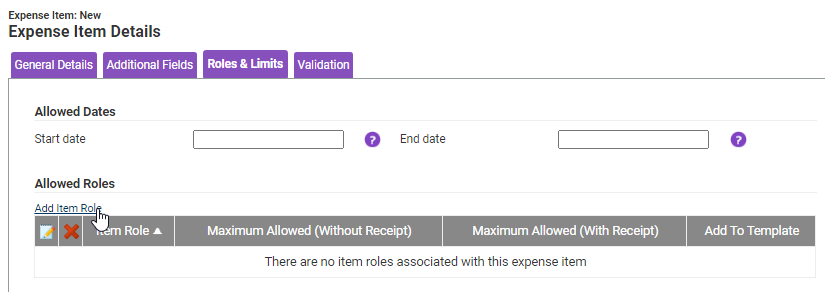

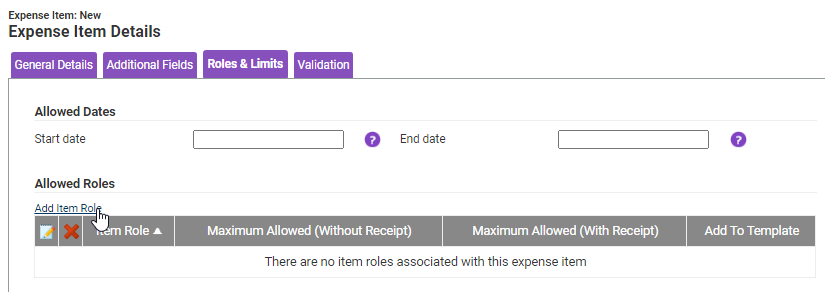

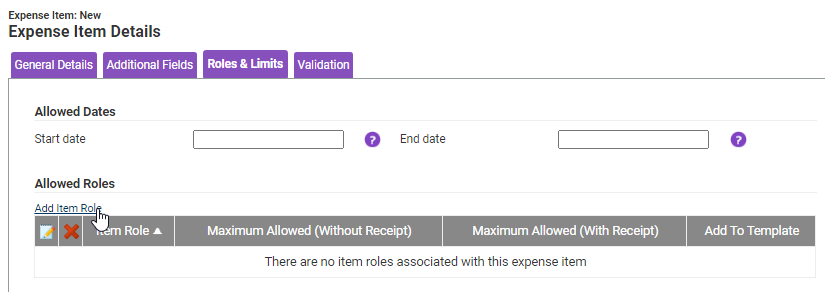

- Within the 'Roles & Limits tab', add the expense item to an Item Role as required.

- Click Save to store the expense item.

Create Fuel Card Receipt Expense Item

To configure the fuel card receipt expense item, follow the steps below:

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items.

- Click New Expense Item. For more information on creating an expense item, view Create an Expense Item.

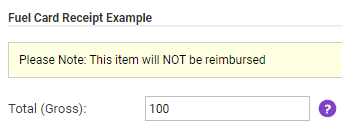

- Within the General Details section, ensure the Reimbursable check box is cleared.

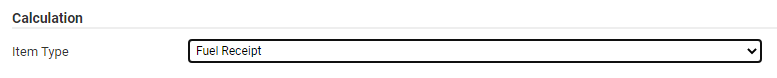

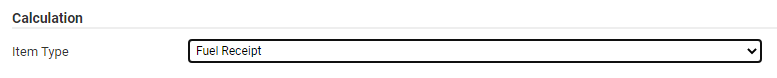

- Ensure that 'Item Type' field is set to Fuel Receipt.

- Within the Roles & Limits tab, add the expense item to an Item Role as required.

- Click Save to store the expense item.

Make Odometer Readings Mandatory

To enforce the input of an odometer reading when a claim is submitted, follow the steps below:

- Navigate from the Home page to Administrative Settings | User Management | Employees.

- Search for the employee record that you want to modify using the Search Options on the Employees page. Click

to edit the employee.

to edit the employee. - Click Vehicle within the Page Options menu.

- Click

next to the employee's active vehicle.

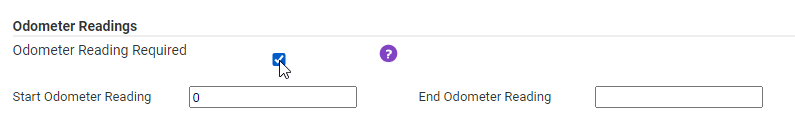

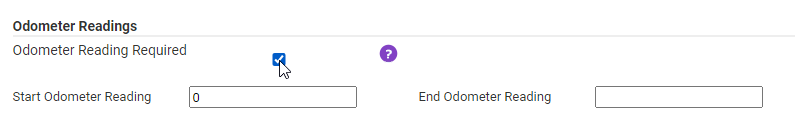

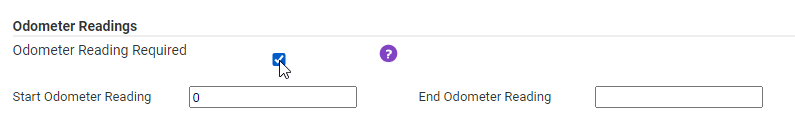

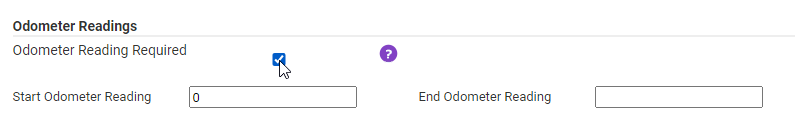

next to the employee's active vehicle. - Click the Odometer Readings tab and select the Odometer Readings Required check box to ensure that an odometer reading is provided when submitting a claim.

Claim Example

This section describes what information a claimant will need to provide in order to deduct personal miles from a fuel card claim.

- Create a new claim or navigate to an existing claim. For more information on creating a claim, view Create a Claim.

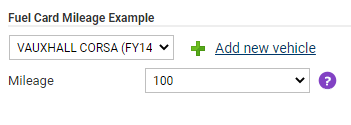

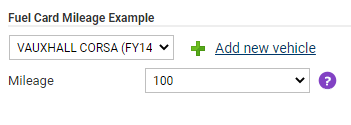

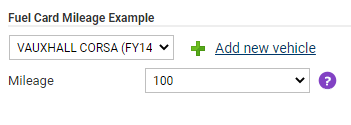

- Add the Fuel Card Mileage expense item, specifying the number of miles travelled for business.

- Add the Fuel Card Receipt expense item, specifying fuel card expenditure.

- Click Submit Claim.

Note: The amount payable is based on your vehicle journey rate and will change after claim submission when Assure Expenses calculates the personal mileage deduction.

- Enter a new odometer reading and click Save.

- Assure Expenses will calculate fuel card mileage and the reimbursable amount will be displayed.

Method 2 - Deduction After Payment

Method 2 guides you on how to configure the system in order to deduct a personal mileage amount after fuel card spend has already been paid in full.

- You will need to create three expense items:

- Private Miles Deduction

- Fuel Card Mileage

- Fuel Card Receipt

- Vehicle odometer readings must be made mandatory when submitting a claim. This will allow Assure Expenses to calculate the difference between business miles and total miles travelled during the period. This will enable a deduction to calculate the correct proportion of the fuel card spend that was used for business miles. The diagram below displays an example calculation that would occur after claim submission:

Create Personal Miles Deduction expense item

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items.

- Click New Expense Item. For more information on creating an expense item, view Create an Expense Item.

- Within the General Details section, ensure the Reimbursable check box is selected.

- Ensure that 'Item Type' field is set to Item Reimburse.

- Within the Roles & Limits tab, add the expense item to an Item Role as required.

Create Fuel Card Mileage expense item

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items.

- Click New Expense Item. For more information on creating an expense item, view Create an Expense Item.

- Within the General Details section, ensure the Reimbursable check box is cleared.

- Ensure that 'Item Type' field is set to Mileage (Pence Per Mile).

- Within the Roles & Limits tab, add the expense item to an Item Role as required.

Create Fuel Card Receipt expense item

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items.

- Click New Expense Item. For more information on creating an expense item, view Create an Expense Item.

- Within the General Details section, ensure that the Reimbursable check box is selected.

Make Odometer Readings Mandatory

To enforce the submission of an odometer reading when a claim is submitted, follow the steps below:

- Navigate from the Home page to Administrative Settings | User Management | Employees.

- Search for the employee record that you want to modify using the Search Options on the Employees page. Click

to edit the employee record.

to edit the employee record. - Click Vehicle within the Page Options menu.

- Click

next to the employee's active vehicle.

next to the employee's active vehicle. - Click the Odometer Readings tab and select the Odometer Readings Required check box to ensure an odometer reading is provided when submitting a claim.

Claim Example

This section describes what information a claimant will need to provide in order to deduct personal miles from a fuel card claim.

- Create a new claim or navigate to an existing claim. For more information on creating a claim, view Create a Claim.

- Add the Fuel Card Mileage expense item, specifying the number of miles travelled for business.

- Add the Fuel Card Receipt expense item, specifying fuel card expenditure.

- Click Submit Claim.

Note: The amount payable is based on your vehicle journey rate and will change after claim submission when Assure Expenses calculates the personal mileage deduction.

- Enter a new odometer reading and click Save.

- Assure Expenses will calculate fuel card mileage and the reimbursable amount will be displayed.

to edit the employee.

to edit the employee.