Permissions

You will require an Access Role with the following permissions:

- Employees

- Expense Items

Introduction

This mileage calculation has been designed primarily for Junior Doctors who move between a number of different work locations as well as having a nominated base location. This provides different rates and deductions based upon where the claimant is travelling to and from.

Description

If your journey is from 'Home' to 'Office' or 'Office' to 'Home', then a deduction will be made that is equal to the distance between 'Home' and your current work location. This will be paid at the Public Transport Rate. If your journey contains a destination other than 'Home' or 'Office', this journey is classed as an 'Official Journey'.

For an 'Official Journey', all mileage will be paid at your Vehicle Journey Rate, apart from the distance between your 'Home' and any other destination. This will be paid at the full Vehicle Journey Rate less the 'Public Transport Rate' for the distance between your current work (Office) and the destination.

Calculations & Examples

Note: PPM = Pence Per Mile.

| Rates | |

|---|---|

| Public Transport Rate | 24 PPM |

| Official Journey Rate | 58 PPM |

| Official Journey Rate minus Public Transport Rate | 34 PPM |

Scenario 1

| Hospital A | Claimant's Nominated Base. |

| Hospital B | Claimant's Current Rotational Work Address (where they currently spend most of their working time). |

| Clinic A | Location which is visited for work purposes, but is not the claimant's Nominated Base or Current Rotational Work Address. |

| Clinic B | Location which is visited for work purposes, but is not the claimant's Nominated Base or Current Rotational Work Address. |

| Journey 1 | Distance | Calculation |

|---|---|---|

| Home - Hospital B | 10 miles | 4 Miles x 24 PPM |

| Hospital B - Home | 10 miles | 4 Miles x 24 PPM |

| Journey 2 | Distance | Calculation |

|---|---|---|

| Home - Hospital A | 6 miles | 0 Miles x 24 PPM |

| Hospital A - Home | 6 miles | 0 Miles x 24 PPM |

| Journey 3 | Distance | Calculation |

|---|---|---|

| Home - Hospital B | 10 miles | (6 Miles x 34 PPM) + (4 Miles x 58 PPM) |

| Hospital B - Hospital A | 5 miles | 5 Miles x 58 PPM |

| Hospital A - Home | 6 miles | 6 Miles x 34 PPM |

| Journey 4 | Distance | Calculation |

|---|---|---|

| Home - Hospital A | 6 miles | 6 Miles x 34 PPM |

| Hospital A - Hospital B | 5 miles | 5 Miles x 58 PPM |

| Hospital B - Home | 10 miles | 10 Miles x 34 PPM |

| Journey 5 | Distance | Calculation |

|---|---|---|

| Home - Hospital A | 6 miles | 6 Miles x 34 PPM |

| Hospital A - Hospital B | 5 miles | 5 Miles x 58 PPM |

| Hospital B - Clinic A | 12 miles | 12 Miles x 58 PPM |

| Clinic A - Home | 15 miles | (12 Miles x 58 PPM) + (3 Miles x 34 PPM) |

| Journey 6 | Distance | Calculation |

|---|---|---|

| Home - Hospital A | 6 miles | 6 Miles x 34 PPM |

| Hospital A - Hospital B | 5 miles | 5 Miles x 58 PPM |

| Hospital B - Clinic A | 12 miles | 12 Miles x 58 PPM |

| Clinic A - Clinic B | 20 miles | 20 Miles x 58 PPM |

| Clinic B - Home | 60 miles | (25 Miles x 58 PPM) + (35 Miles x 34 PPM) |

Note: We assume that Hospital B to Clinic B is 25 Miles.

Scenario 2

| Hospital A | Claimant's Nominated Base and Current Rotational Work Address. |

| Hospital B | A Rotational Work Address, which the claimant is not currently located at. |

| Clinic A | Location which is visited for work purposes, but is not the claimant's Nominated Base or Current Rotational Work Address. |

| Clinic B | Location which is visited for work purposes, but is not the claimant's Nominated Base or Current Rotational Work Address. |

| Journey 7 | Distance | Calculation |

|---|---|---|

| Home - Hospital B | 10 miles | (6 Miles x 34 PPM) + (4 Miles x 58 PPM) |

| Hospital B - Home | 10 miles | (6 Miles x 34 PPM) + (4 Miles x 58 PPM) |

| Journey 8 | Distance | Calculation |

|---|---|---|

| Home - Hospital A | 6 miles | 6 Miles x 0 PPM |

| Hospital A - Home | 6 miles | 6 Miles x 0 PPM |

| Journey 9 | Distance | Calculation |

|---|---|---|

| Home - Hospital B | 10 miles | (6 Miles x 34 PPM) + (4 Miles x 58 PPM) |

| Hospital B - Hospital A | 5 miles | 5 Miles x 58 PPM |

| Hospital A - Home | 6 miles | 6 Miles x 34 PPM |

Configuring an Expense Item

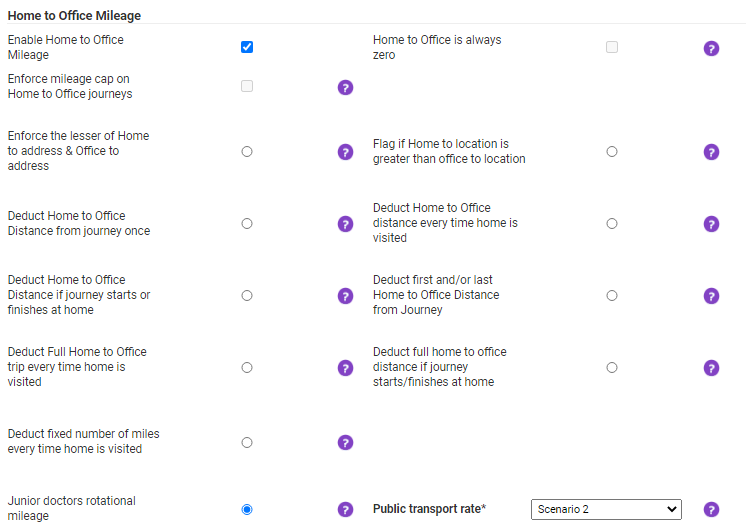

A new/existing Expense Item will need to be configured to include the Junior Doctors Rotational Mileage rule and to specify what the Public Transport Rate will pay.

- Navigate from the Home page to Administrative Settings | Base Information | Expense Items. Choose whether to create a new Expense Item to apply this mileage rule to or edit an existing Expense Item. For more information on how to configure an Expense Item, view Create an Expense Item.

- Within the Expense Item Details page you must specify the following:

- The Item Type must be set as Mileage (Pence Per Mile).

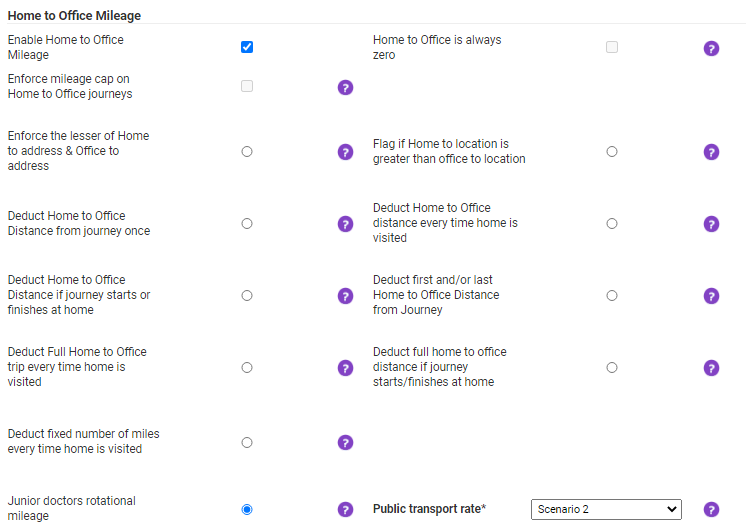

- Tick the check box for Enable Home to Office Mileage.

- Complete the rest of the Expense Item configuration.

Work Addresses

The claimants that will use this mileage rule will need their nominated base specifying within their employee record, so that the correct deductions can be made on mileage claims.

- Navigate from the Home page to Administrative Settings | User Management | Employees.

- Search for the claimant who you will edit the Work Address for. For more information on how to configure a Work Address, view Add Home & Work Addresses.

- For the claimant's nominated base, tick the Nominated Base check box within the Work Address General Details.

Note: A claimant's Current Rotational Work Address is defined by the rotational address with the most recent Start Date. If your organisation is using the ESR GO2 interface, the Current Rotational Work Address is defined by the Work Location linked to your ESR Assignment.

Note: If more than one Work Address is marked as the Nominated Base, Assure Expenses will automatically select one from the claimant's list of Work Addresses.