Permissions

You will require an Access Role with the following permissions:

- Base Information

- Vehicle Journey Rate Categories

Add a Vehicle Journey Rate

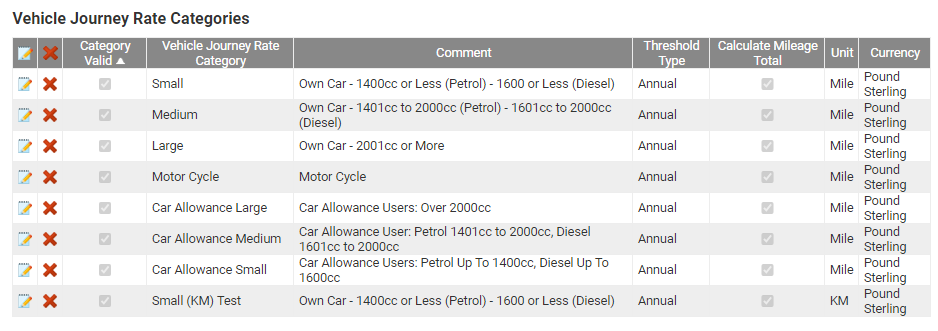

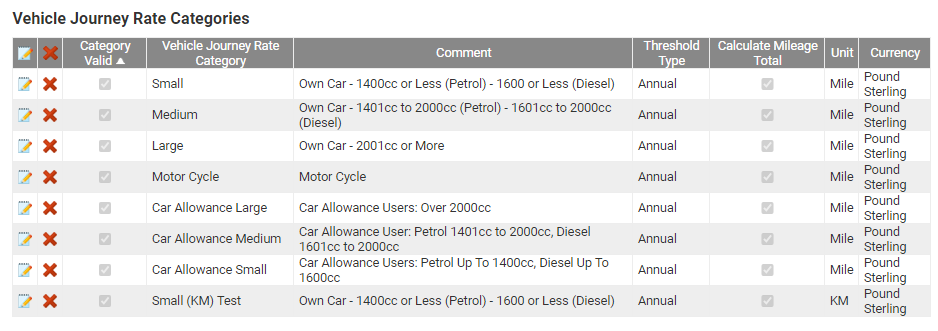

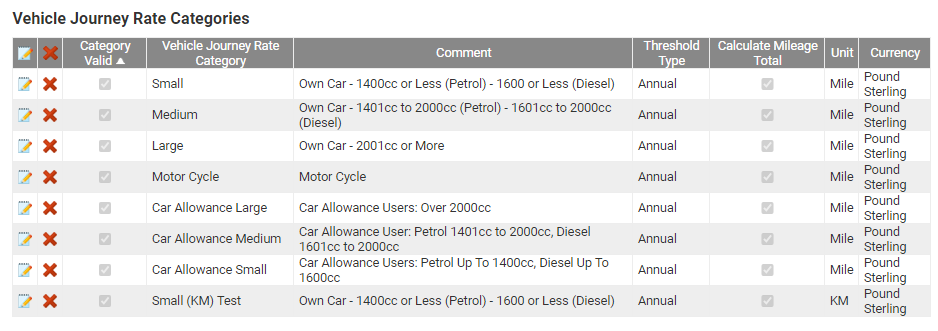

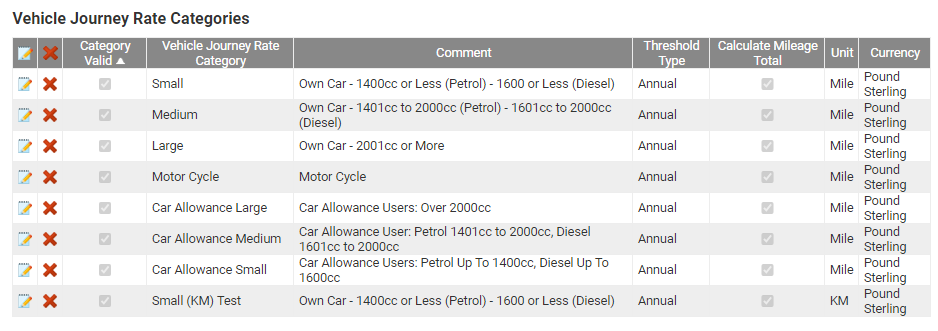

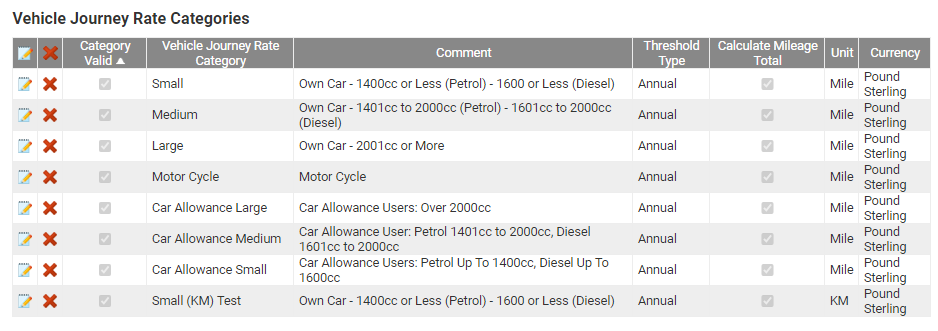

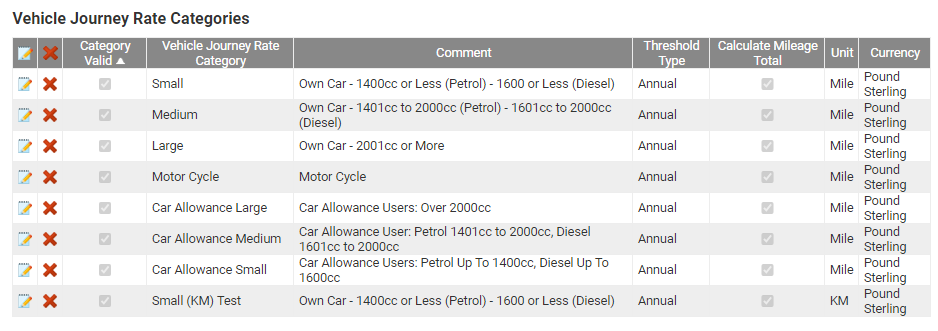

- Navigate from the Home page to Administrative Settings | Base information | Vehicle Journey Rate Categories. This will return a list of any existing Vehicle Journey Rate Categories.

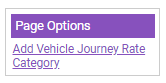

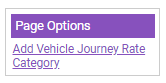

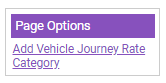

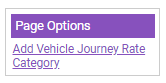

- From the Page Options menu, click Add Vehicle Journey Rate Category.

Note: Click

to edit an existing Vehicle Journey Rate Category.

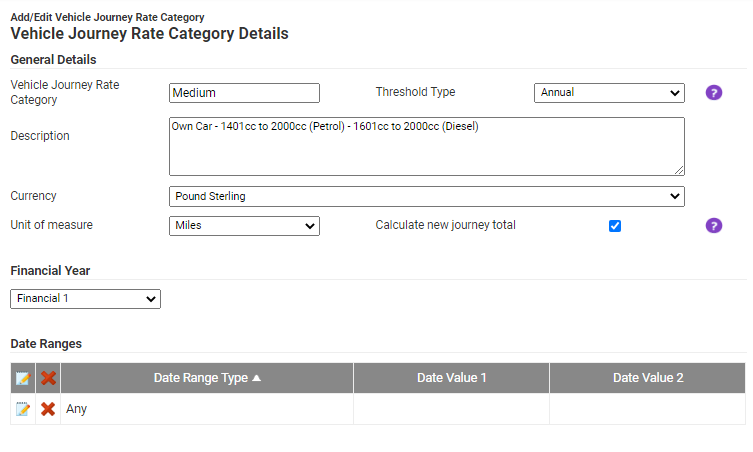

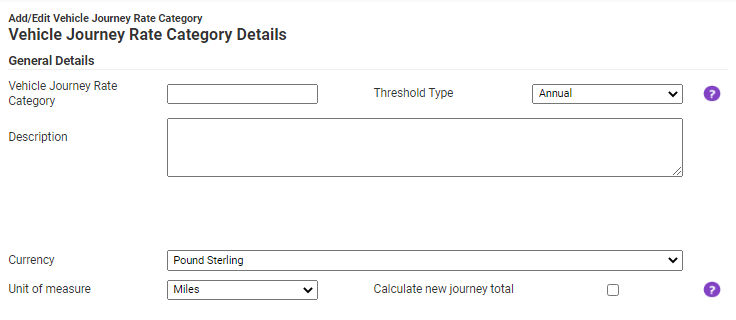

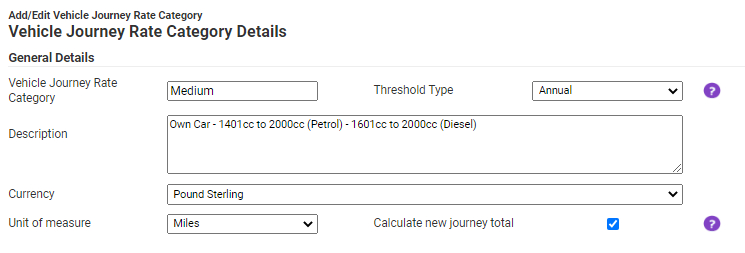

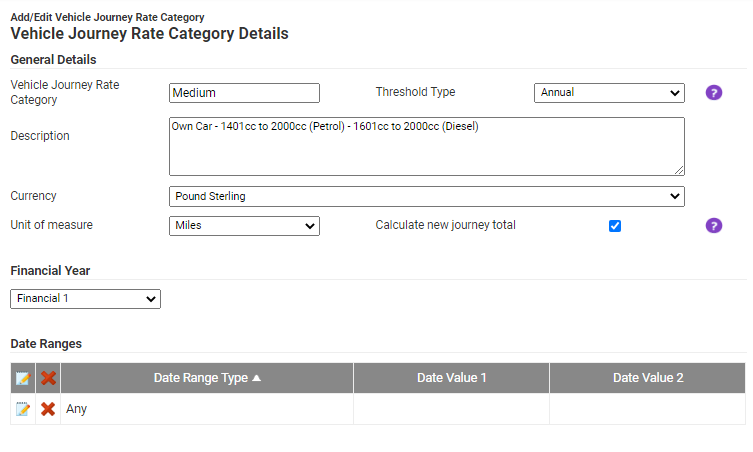

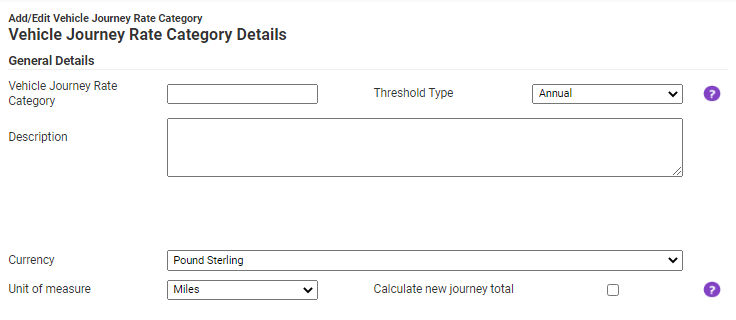

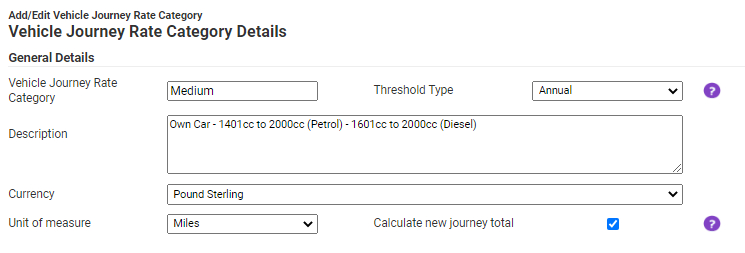

to edit an existing Vehicle Journey Rate Category. - Define the General Details of the Vehicle Journey Rate Category:

General Details Description Vehicle Journey Rate Category Select the type of threshold which applies to this Vehicle Journey Rate Category: - Annual - Checks the total number of miles accrued over the current financial year to determine which threshold rate applies.

- Per Journey - The threshold will be checked for each journey.

Threshold Type Enter a description to help identify what the purpose of the Vehicle Journey Rate Category is. Currency Select a currency from the drop down list to apply to this Vehicle Journey Rate Category. Unit of Measure Select a unit of measure to apply to the Vehicle Journey Rate Category: - Miles - The specified rate will be paid per Mile travelled.

- Kilometres - The specified rate will be paid per Kilometer travelled.

Calculate New Journey Total Select this option if you want to store a running total of the number of miles accrued by the claimant who uses this Vehicle Journey Rate Category. Note: NHS users may also be required to enter further information such as NHS Mileage Code, Start Engine Size and End Engine Size.

- Annual - Checks the total number of miles accrued over the current financial year to determine which threshold rate applies.

- If you have multiple Financial Years to select from, define this selection using the Financial Year drop-down list. If you only have one Financial Year, Assure Expenses will automatically default to this.

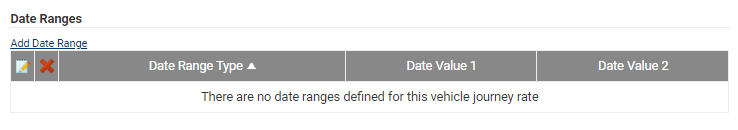

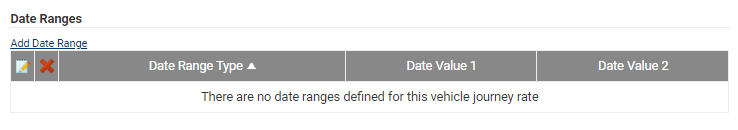

Add a Date Range

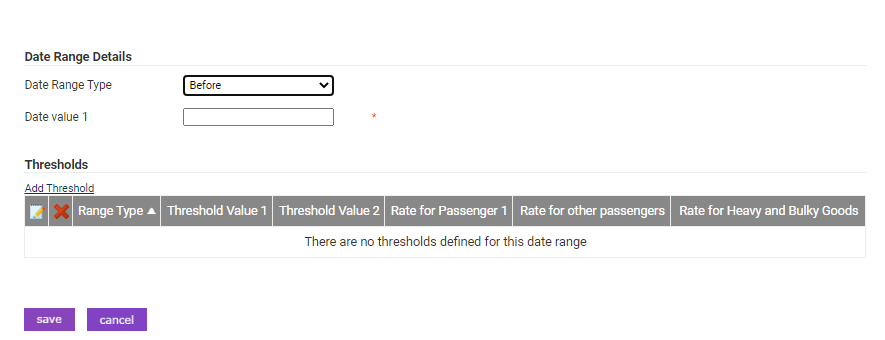

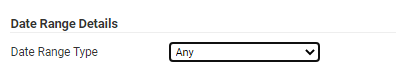

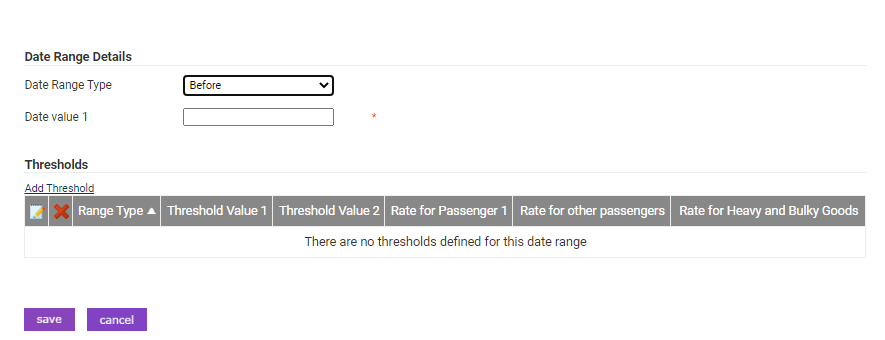

- Click the Add Date Range link to select a Date Range Type.

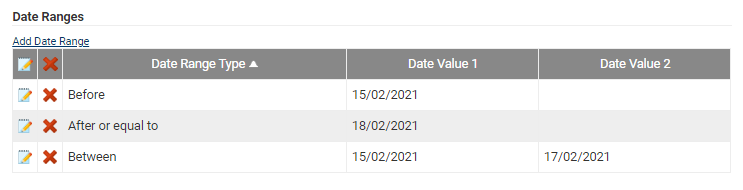

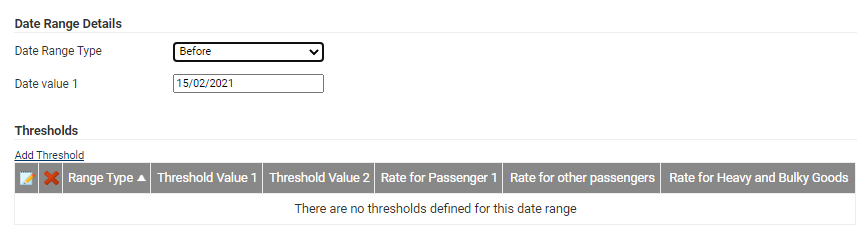

Date Range Type Description Before (Exclusive) This will apply the Vehicle Journey Rate Category up to the date selected, but not including the date selected. You are only able to add one Before Date Range per Vehicle Journey Rate Category. After or equal to (Inclusive) This will apply the Vehicle Journey Rate Category on or after the date specified. You are only able to add one After or equal to Date Range per Vehicle Journey Rate Category. Between (Inclusive) This will apply the Vehicle Journey Rate Category between the two dates selected, including the selected dates. Any This will apply the Vehicle Journey Rate to all dates. - Enter the date/s into the Date Value field/s for the duration that the Vehicle Journey Rate Category will apply.

Add Threshold Details

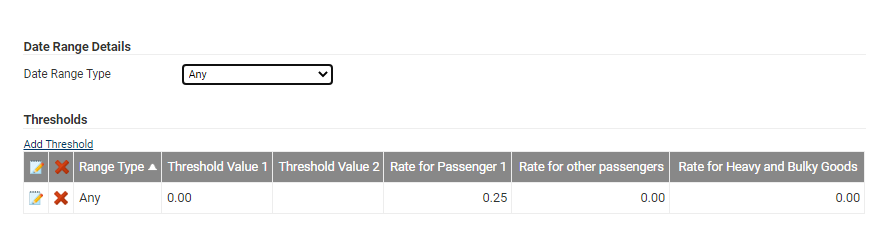

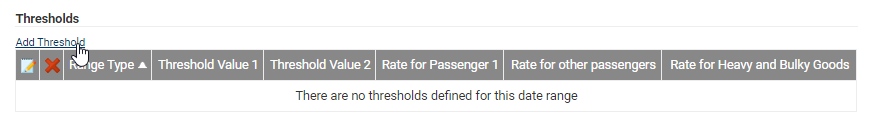

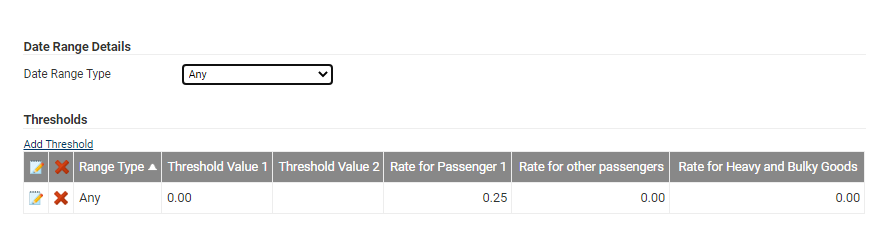

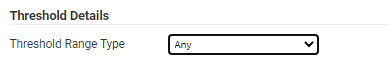

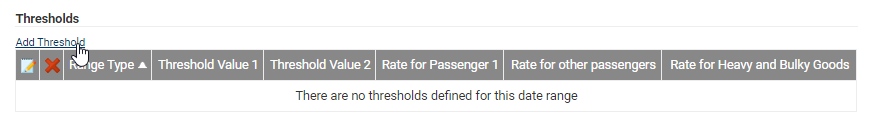

- Within the Add Date Range window, click the Add Threshold link.

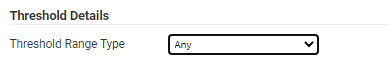

- The Threshold Range Type rules can adjust the rates so that once the claimant exceeds the set threshold the correct rate is applied automatically. Enter the mileage threshold/s in the Threshold Value field/s.

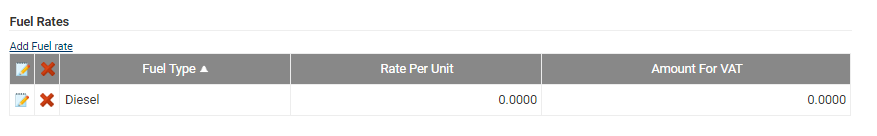

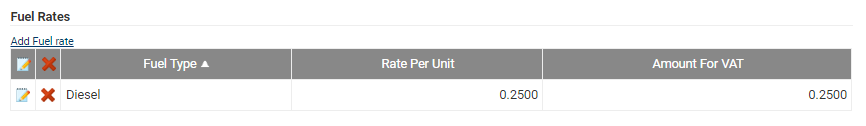

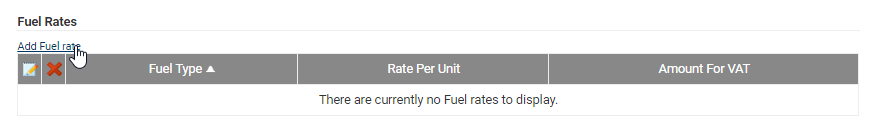

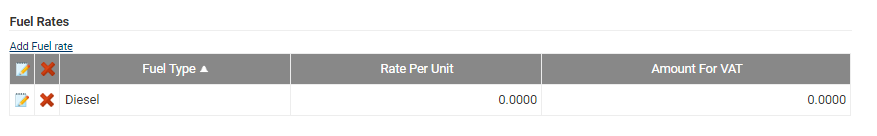

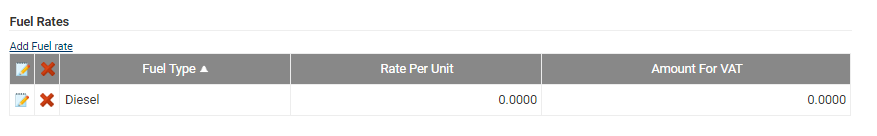

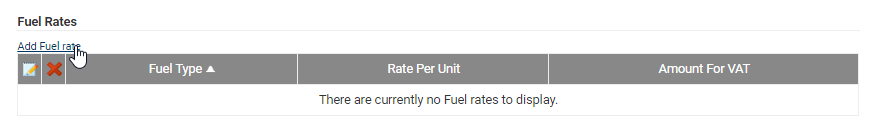

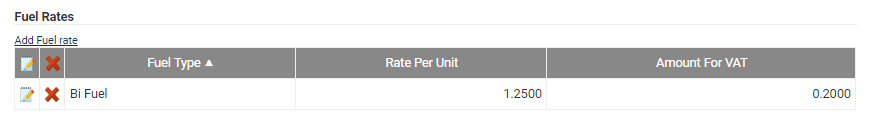

Range Type Description Less Than (Exclusive) This will apply the correct rate up to the mileage threshold which is defined, but not including the mileage threshold specifically. You are only able to add one Less Than threshold per Date Range. Greater than or equal to (Inclusive) This will apply the correct rate to mileage greater than or equal to the mileage threshold which is defined. You are only able to add one After or equal to threshold per Date Range. Between (Inclusive) This will apply the correct rate between the two mileage thresholds which have been defined, including the threshold values specifically. Any This will apply the correct rate to all mileage thresholds. - Click the Add Fuel Rate link to define a Fuel Rate to apply to the threshold.

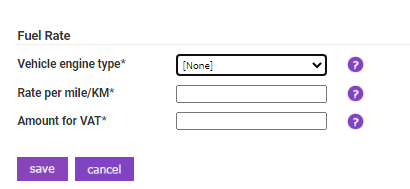

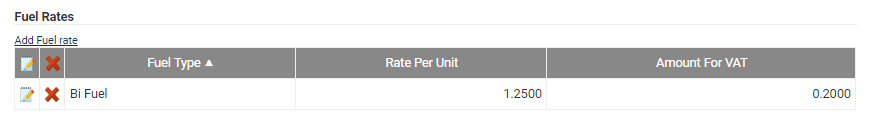

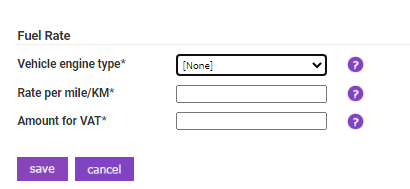

Option Description Vehicle engine type (Mandatory) Select the vehicle engine type from the Vehicle Engine Type drop-down list. For more information on Vehicle Engine Types, view Manage Vehicle Engine Types. Rate per mile/Km (Mandatory) Enter a Rate per mile/KM. This is the rate the claimant will be paid for each mile/Km they claim for. For example, entering 0.25 will pay the claimant £0.25 per mile/KM claimed. Amount for VAT (Mandatory) Enter the amount per mile/Km which is subject to VAT. This number must be less than or equal to the Rate per mile/KM. - Click Save to store the Fuel Rate.

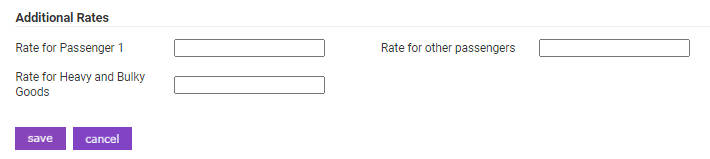

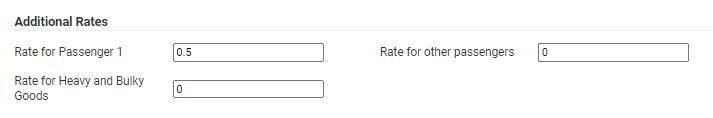

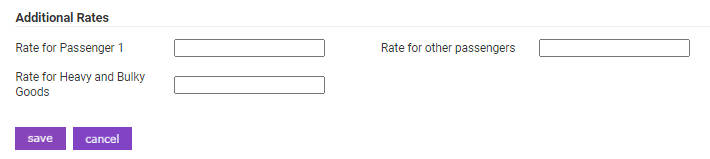

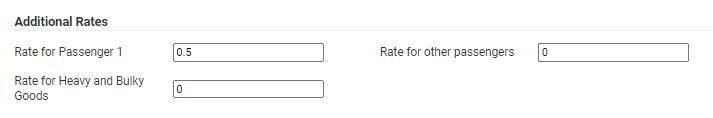

- In the Additional Rates section, enter the rates for carrying passengers or heavy and bulky goods, if applicable. If a claimant specifies that on their journey, they were carrying a passenger or heavy and bulky goods, the rates defined will be also be paid on top of the normal rate.

- Once all the rates have been entered, continue to click Save until you are directed back to the Vehicle Journey Rate Categories page.

For more detailed scenarios of setting up a Vehicle Journey Rate Category, view the tabs at the top of this page.

Note: You will need to create a new vehicle journey rate category for each engine size. You can find a list of advisory fuel rates based on engine sizes by visiting GOV.UK.

Edit a Vehicle Journey Rate

- Navigate from the Home page to Administrative Settings | Base information | Vehicle Journey Rate Categories. This will return a list of any existing Vehicle Journey Rate Categories.

- Find the Vehicle Journey Rate Category you want to modify and click

.

. - Modify the General Details of the Vehicle Journey Rate Category as required:

General Details Description Vehicle Journey Rate Category Select the type of threshold which applies to this Vehicle Journey Rate Category: - Annual - Checks the total number of miles accrued over the current financial year to determine which threshold rate applies.

- Per Journey - The threshold will be checked for each journey.

Threshold Type Enter a description to help identify what the purpose of the Vehicle Journey Rate Category is. Currency Select a currency from the drop down list to apply to this Vehicle Journey Rate Category. Unit of Measure Select a unit of measure to apply to the Vehicle Journey Rate Category: - Miles - The specified rate will be paid per Mile travelled.

- Kilometres - The specified rate will be paid per Kilometer travelled.

Calculate New Journey Total Select this option if you want to store a running total of the number of miles accrued by the claimant who uses this Vehicle Journey Rate Category. Note: NHS users may also be required to enter further information such as NHS Mileage Code, Start Engine Size and End Engine Size.

- Annual - Checks the total number of miles accrued over the current financial year to determine which threshold rate applies.

Edit a Date Range

- Scroll down to the Date Ranges section and click

on a Date Range.

on a Date Range.

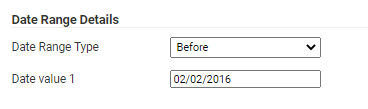

- Select a Date Range Type:

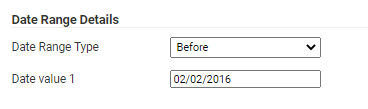

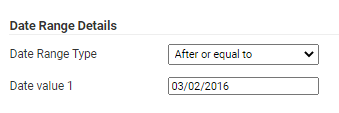

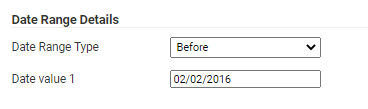

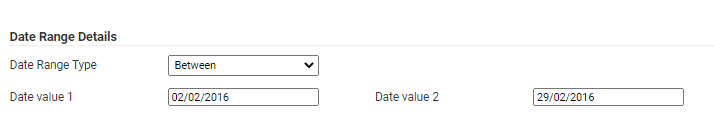

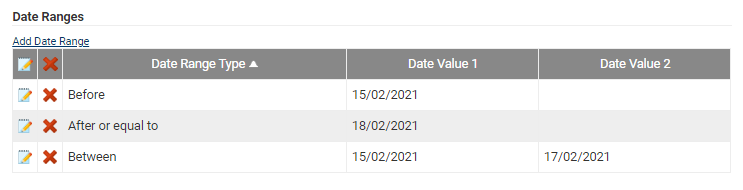

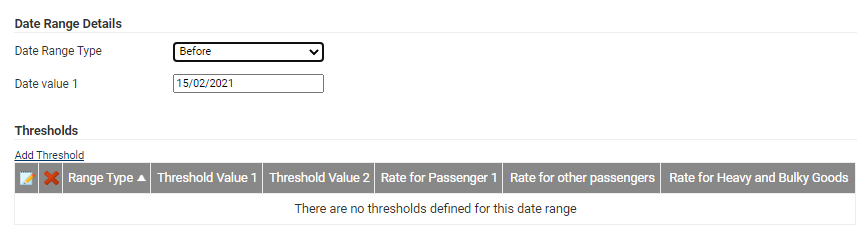

Date Range Type Description Before (Exclusive) This will apply the Vehicle Journey Rate Category up to the date selected, but not including the date selected. You are only able to add one Before Date Range per Vehicle Journey Rate Category. After or equal to (Inclusive) This will apply the Vehicle Journey Rate Category on or after the date specified. You are only able to add one After or equal to Date Range per Vehicle Journey Rate Category. Between (Inclusive) This will apply the Vehicle Journey Rate Category between the two dates selected, including the selected dates. Any This will apply the Vehicle Journey Rate to all Note: Choosing the correct dates is important as it can affect the validity of your journey rate. The picture below shows a valid set of working dates.

- Enter the date/s into the Date Value field/s for the duration that the Vehicle Journey Rate Category will apply.

Edit Threshold Details

- Within the Date Range Details window, to modify a Threshold, click

.

.

- The Threshold Range Type rules can adjust the rates so that once the claimant exceeds the set threshold, the correct rate is applied automatically. Enter the mileage threshold/s in the Threshold Value field/s.

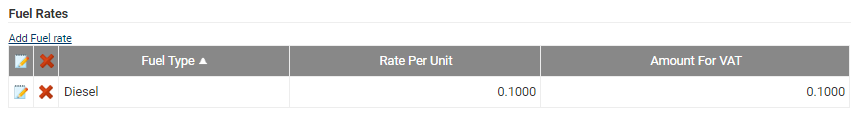

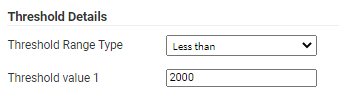

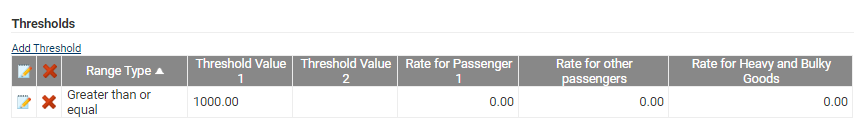

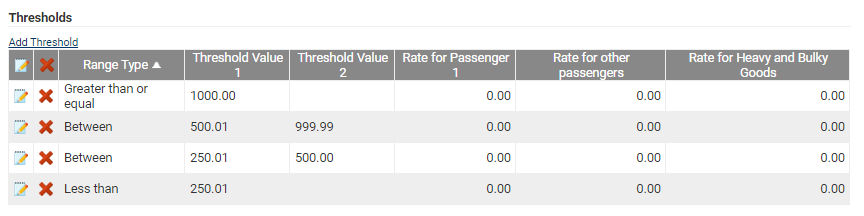

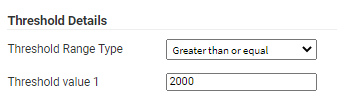

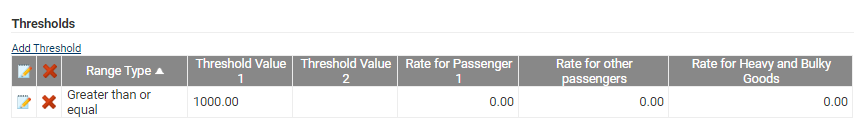

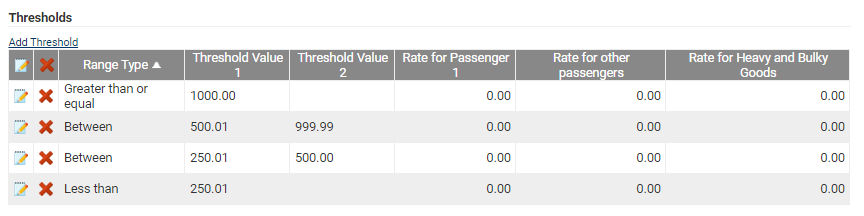

Range Type Description Less Than (Exclusive) This will apply the correct rate up to the mileage threshold which is defined, but not including the mileage threshold specifically. You are only able to add one Less Than threshold per Date Range. Greater than or equal to (Inclusive) This will apply the correct rate to mileage greater than or equal to the mileage threshold which is defined. You are only able to add one After or equal to threshold per Date Range. Between (Inclusive) This will apply the correct rate between the two mileage thresholds which have been defined, including the threshold values specifically. Any This will apply the correct rate to all mileage thresholds. Note: It is important that you set clear thresholds to two decimal places. The picture below provides an example of working threshold rates.

- Within the Threshold Details window, to modify a Fuel Rate, click

.

.

Option Description Vehicle engine type (Mandatory) Select the vehicle engine type from the Vehicle Engine Type drop-down list. For more information on Vehicle Engine Types, view Manage Vehicle Engine Types. Rate per mile/Km (Mandatory) Enter a Rate per mile/KM. This is the rate the claimant will be paid for each mile/Km they claim for. For example, entering 0.25 will pay the claimant £0.25 per mile/KM claimed. Amount for VAT (Mandatory) Enter the amount per mile/Km which is subject to VAT. This number must be less than or equal to the Rate per mile/KM. - Click Save to store the Fuel Rate.

- In the Additional Rates section, enter the rates for carrying passengers or heavy and bulky goods, if applicable. If a claimant specifies that on their journey, they were carrying a passenger or heavy and bulky goods, the rates defined will be also be paid on top of the normal rate.

- Once all the rates have been entered, continue to click Save until you are directed back to the Vehicle Journey Rate Categories page.

For more detailed scenarios of setting up a Vehicle Journey Rate Category, view the tabs at the top of this page.

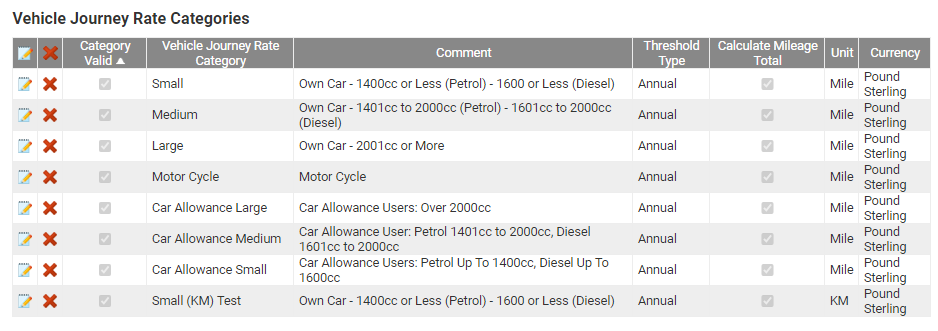

Review Vehicle Journey Rates

- Navigate from the homepage to Administrative Settings | Base information | Vehicle Journey Rate Categories. This will return a list of any existing Vehicle Journey Rate Categories.

- Navigate to the journey rate you want to review and click

.

.Note: 'Category Valid' enables legislation and company policy to be enforced. The 'Category Valid' column will be selected if a claimant is able to see that vehicle journey rate when adding an expense. The validity of a category can change each financial year or if your company's policy changes. For example, changing the date range of a journey rate can affect the validity.

Some categories will still display on the 'Vehicle Journey Rate Categories' page even if the validity is not selected. This is for financial and legal reasons. - Under 'Date Ranges' click

next to the date range that you want to review. In this case, the date range is set to 'any'.

next to the date range that you want to review. In this case, the date range is set to 'any'.

Note: In this case the mileage is set to miles (rather than km) and is measured annually for vehicles with engine sizes between 1401cc and 2000cc (petrol) and 1601cc and 2000cc (diesel).

- Under 'Thresholds' you can find the vehicle journey rates. In this case, the rate is set at 25 pence per mile for any mileage distance for the driver. Any passengers will receive 20 pence per mile.

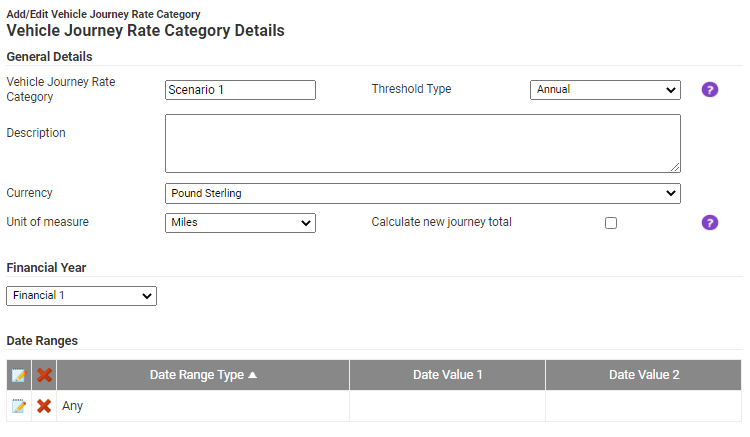

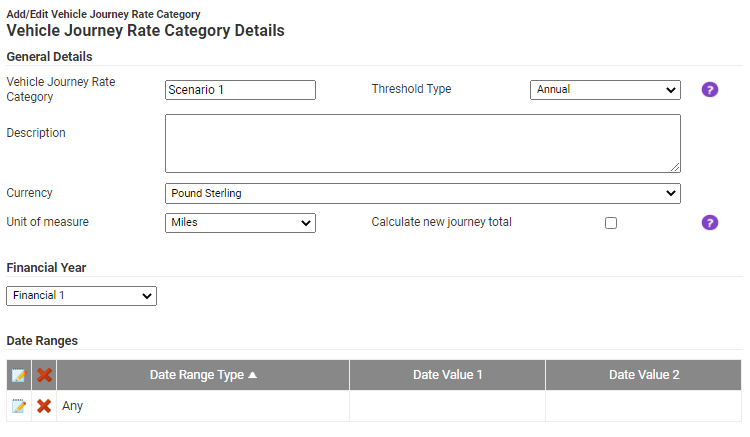

Scenario 1

In this Scenario, the following rules will be specified:

- At any date, a rate of £0.00 can be claimed.

Note: This will require a Date Range of Any.

- Navigate from the Home page to Administrative Settings | Base information | Vehicle Journey Rate Categories.

- Click on the Add Vehicle Journey Rate Category link in the Page Options menu to add a new Vehicle Journey Rate.

- Alternatively, click the

icon to edit or update an existing category.

icon to edit or update an existing category.

- Alternatively, click the

- Click the Add Date Range link which allows you to specify the date range which applies to this Vehicle Journey Rate Category. Select a Date Range Type of Any.

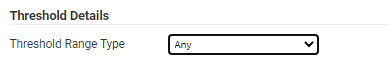

- Click Add Threshold and then set the Threshold Range Type to Any.

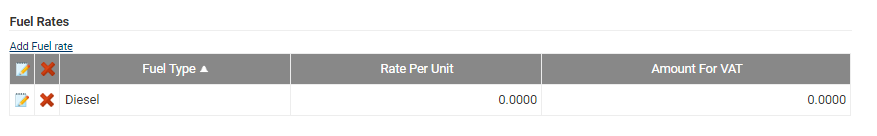

- Click Add Fuel rate and then set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.

- Set the Amount for VAT to 0 (or as per your organisation's policy).

- Click Save until you return to the Vehicle Journey Rate Categories menu. The setup for the Vehicle Journey Rate Category should look like this:

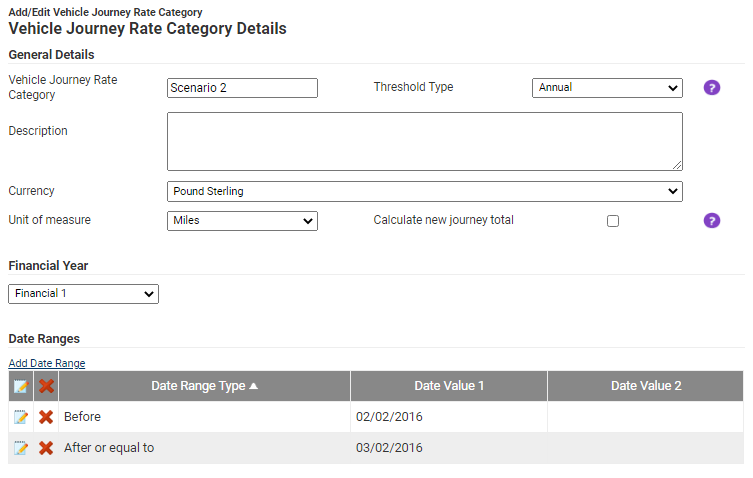

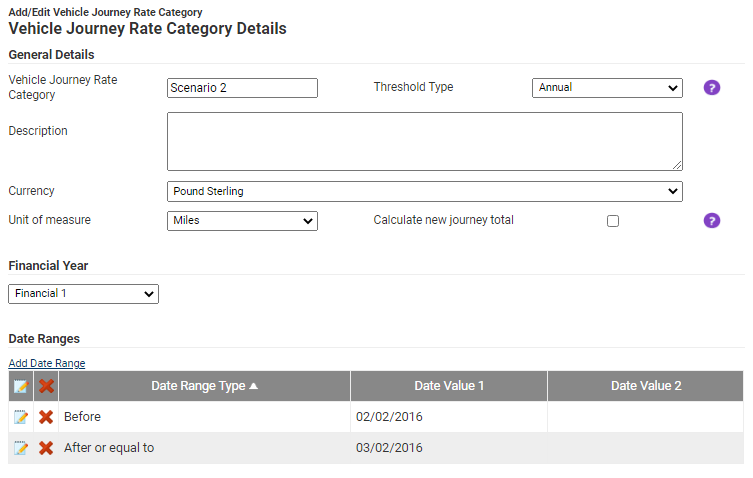

Scenario 2

In this Scenario, the following rules will be specified:

- Before 01/02/2016, a rate of £0.00 can be claimed.

- After or equal to 03/02/2016, a rate of £0.25 can be claimed per mile/KM.

Note: This will require Date Ranges of type, Before and After or equal to.

- Navigate from the Homepage to Administrative Settings | Base information | Vehicle Journey Rate Categories.

- Click on the Add Vehicle Journey Rate Category link in the Page Options menu.

- Alternatively, click the

icon to edit or update an existing Vehicle Journey Rate Category.

icon to edit or update an existing Vehicle Journey Rate Category.

- Alternatively, click the

Part 1 – Before Date Range

In this part of the guide, you will be specifying the first date range to apply to the Vehicle Journey Rate Category.

- Click the Add Date Range link which allows you to specify the date range which applies to this Vehicle Journey Rate Category. In this step, you will need to specify the first date range for this scenario by selecting a Date Range Type of Before.

- Define a Date Value 1 of 01/02/2016.

- Click the Add Threshold link which allows you to specify the mileage thresholds which apply to this Date Range. Select a Threshold Type of Any.

Note: The value entered for a mileage threshold is set to two decimal places. Therefore, if you enter 2, this will be converted to 2.00.

- Click Add Fuel rate and set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.

- Set the Amount for VAT to 0.

- Click Save and then click Save again.

Part 2 – After or Equal To Date Range

In this part of the guide, you will be specifying the second date range to apply to the Vehicle Journey Rate Category.

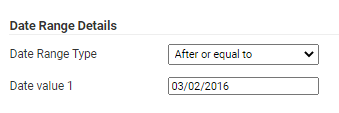

- Click the Add Date Range link to display a modal which allows you to select a Date Range Type of After or equal to.

- Define the Date Value 1 as 03/02/2016.

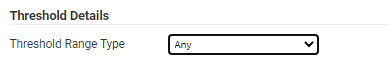

- Click the Add Threshold link which allows you to specify the mileage thresholds which apply to this Date Range. Select a Threshold Type of Any.

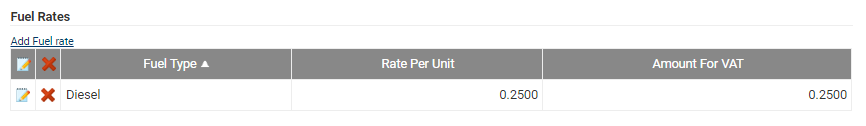

- Click Add Fuel rate and set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.25.

- Set the Amount for VAT to 0.25 (or as per your organisation’s policy).

- Click Save until you are returned to the Vehicle Journey Rate Categories menu. The setup for the Vehicle Journey Rate Category should look like this:

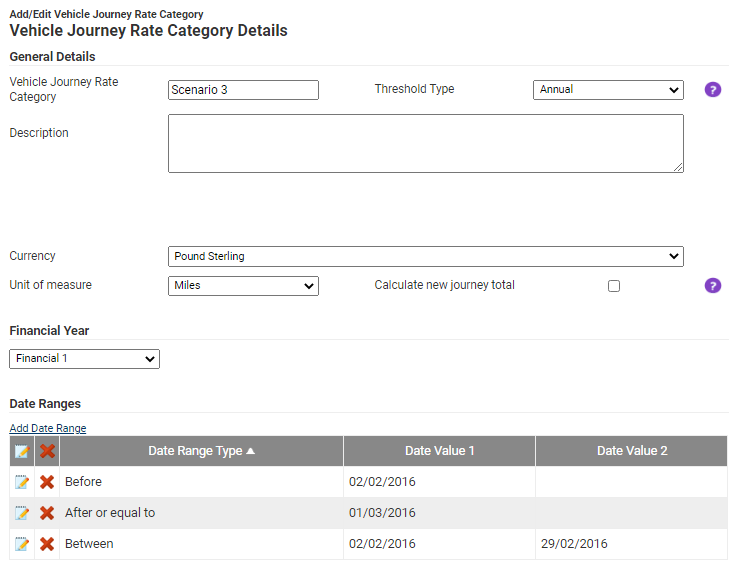

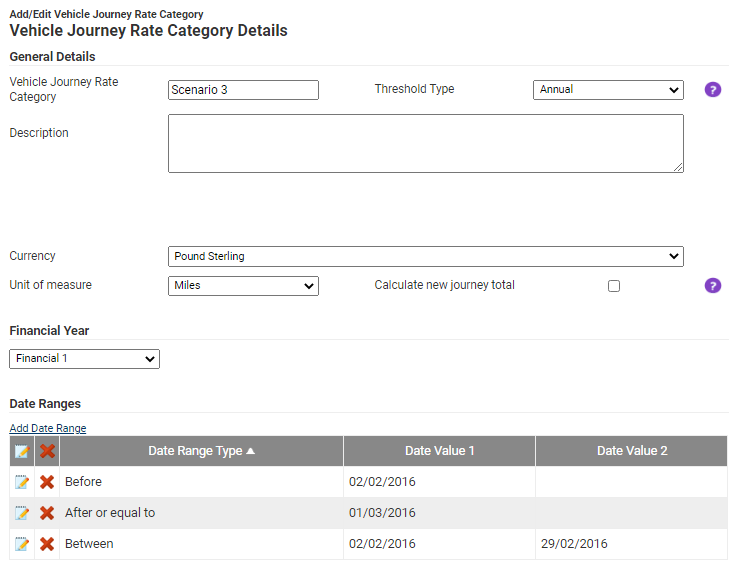

Scenario 3

In this Scenario, the following rules will be specified:

- Before 02/02/2016, a rate of £0.00 can be claimed.

- Between 02/02/2016 and 29/02/2016:

- Less than 2000 miles/KM, a rate of £0.50 can be claimed per mile/KM.

- Greater than or equal to 2000 miles/KM, a rate of £0.10 can be claimed per mile/KM.

- After to or equal to 01/03/2016:

- Less than 2000 miles/KM, a rate of £0.25 can be claimed per mile/KM.

- Greater than or equal to 2000 miles/KM, a rate of £0.10 can be claimed per mile/KM.

Note: This will require Date Ranges of Before, Between and After or equal to.

- Navigate from the Home page to Administrative Settings | Base information | Vehicle Journey Rate Categories.

- Click on the Add Vehicle Journey Rate Category link in the Page Options menu.

- Alternatively, click the

icon to edit or update an existing Vehicle Journey Rate Category.

icon to edit or update an existing Vehicle Journey Rate Category.

- Alternatively, click the

Part 1 – Before Date Range

In this part of the guide, you will be specifying the first date range to apply to the Vehicle Journey Rate Category.

- Click the Add Date Range link which allows you to specify the date range which applies to this Vehicle Journey Rate Category. Select a Date Range Type of Before.

- Define a Date Value 1 of 02/02/2016.

- Click the Add Threshold link which allows you to specify the mileage thresholds which apply to this Date Range. Select a Threshold Type of Any.

Note: The value entered for a mileage threshold is set to two decimal places. Therefore, if you enter 2, this will be converted to 2.00.

- Click Add Fuel rate and set the Vehicle engine type.

- Set the Rate per mile/KM to 0

- Set the Amount for VAT to 0 (or as per your organisation’s policy)

- Click Save until you return to the Vehicle Journey Rate Category Details screen.

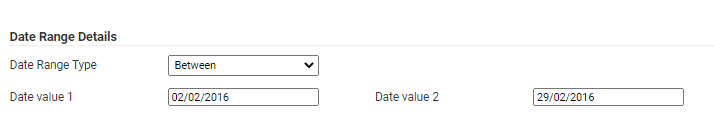

Part 2 – Between Date Range

In this part of the guide, you will be specifying the second date range to apply to the Vehicle Journey Rate Category.

- Click the Add Date Range link which allows you to specify a date range which applies to this Vehicle Journey Rate Category. Select a Date Range Type of Between.

- Define Date Value 1 as 02/02/2016 and then set Date Value 2 as 29/02/2016.

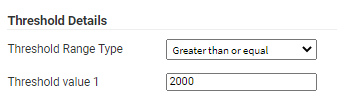

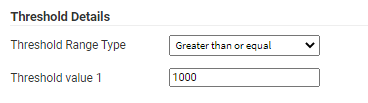

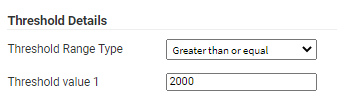

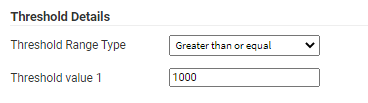

“Greater than or equal” threshold

- Click the Add Threshold link which allows you to specify the mileage thresholds which apply to this Date Range. Select a Threshold Type of Greater than or equal.

- Define the Threshold Value 1 as 2000 (miles).

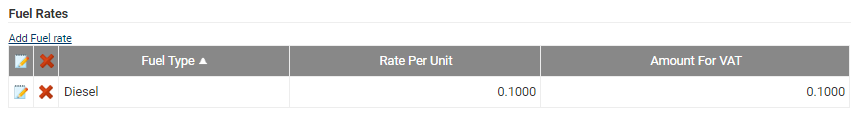

- Click the Add Fuel rate link and set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.10.

- Set the Amount for VAT to 0.10 (or as per your organisation’s policy).

- Click Save and then click Save again.

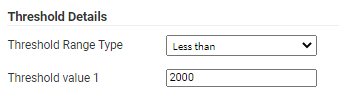

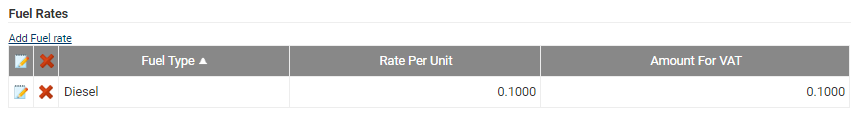

“Less than” threshold

- Click the Add Threshold link and select a Threshold Type of Less than.

- Define the Threshold Value 1 as 2000 (miles).

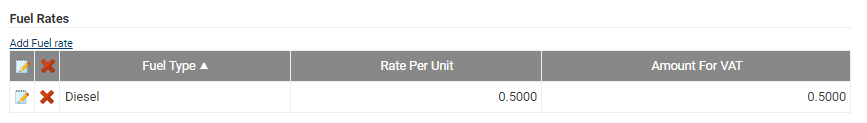

- Click the Add Fuel rate link and set the Vehicle Engine Type.

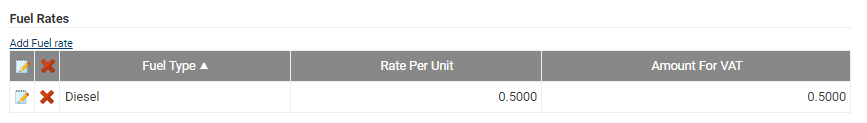

- Set the Rate per mile/KM to 0.50.

- Set the Amount for VAT to 0.50 (or as per your organisation’s policy)

- Click Save until you return to the Vehicle Journey Rate Category Details screen.

Part 3 – After or Equal To Date Range

In this part of the guide, you will be specifying the final date range to apply to the Vehicle Journey Rate Category.

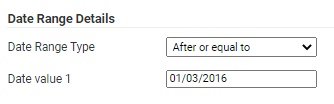

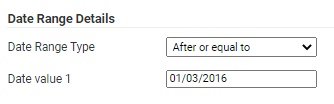

- Click the Add Date Range link which allows you to specify a date range which applies to this Vehicle Journey Rate Category. Select a Date Range Type of After or Equal To.

- Define Date Value 1 as 01/03/2016.

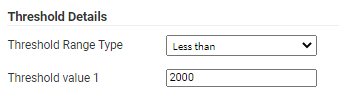

“Greater than or equal” threshold

- Click the Add Threshold link and select a Threshold Type of Greater than or equal.

- Define the Threshold Value 1 as 2000 (miles).

- Click the Add Fuel rate link and set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.10.

- Set the Amount for VAT to 0.10 (or as per your organisation’s policy)

- Click Save and then click Save again.

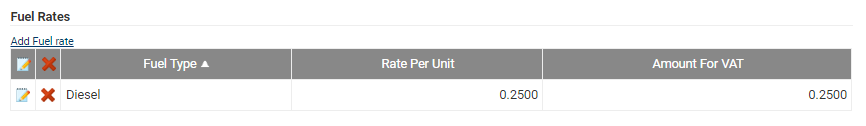

“Less than” threshold

- Click the Add Threshold link and select a Threshold Type of Less Than.

- Define the Threshold Value 1 as 2000 (miles).

- Click the Add Fuel rate link and set the Vehicle Engine Type.

- Set the Rate per mile/KM to 0.25.

- Set the Amount for VAT to 0.25 (or as per your organisation’s policy).

- Click Save until you are returned to the 'Vehicle Journey Rate Categories' menu. The setup for the Vehicle Journey Rate Category should look like this:

to edit an existing Vehicle Journey Rate Category.

to edit an existing Vehicle Journey Rate Category.

next to the date range that you want to review. In this case, the date range is set to 'any'.

next to the date range that you want to review. In this case, the date range is set to 'any'.