Permissions

You will require an Access Role with the following permissions:

- Countries

Add a Country

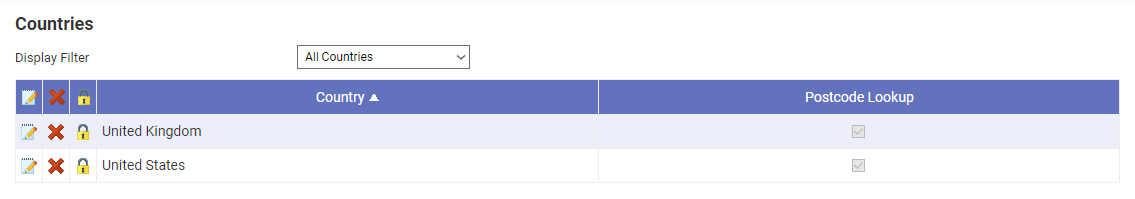

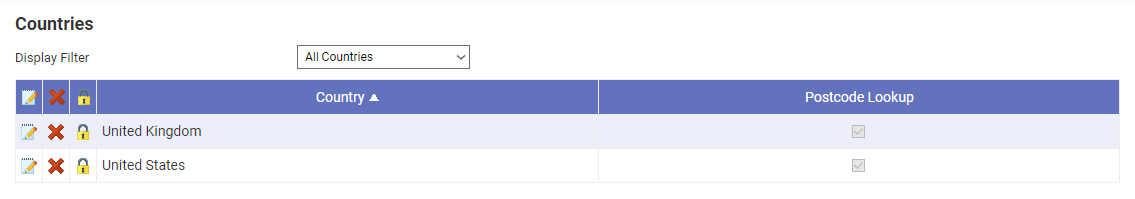

- Navigate from the Homepage to Administrative Settings | Base Information | Countries. This will display the existing list of countries which have been configured within your system.

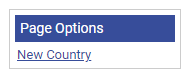

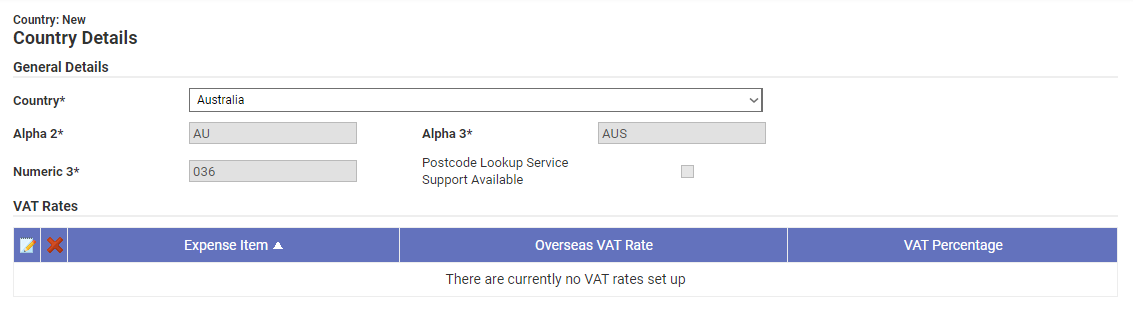

- Click New Country from the Page Options menu.

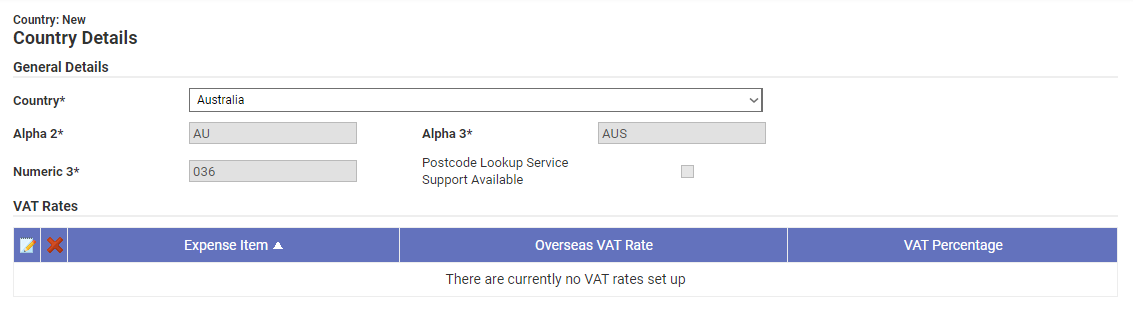

- Select the required country from the Country drop down menu. The Country field includes a list of pre-defined countries; selecting one will automatically populate the country codes and the Postcode Anywhere Support status.

- At this point, you can either save the country that you have added, or proceed to specify VAT rates.

Note: All Assure Expenses Items will default to the system default country, for example, United Kingdom, unless otherwise specified in an employee's record, under the Primary Country field. For overseas expenses, you will be required to select the appropriate country from the Country drop down menu on the Add/Edit Expense page.

Add a VAT Rate

It may be possible to reclaim the VAT that you have paid in other EU countries if you are VAT registered within the UK and have bought the goods or services for your business. What you can reclaim will depend upon the individual country's rules for claiming input tax and certain conditions of registration.

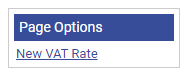

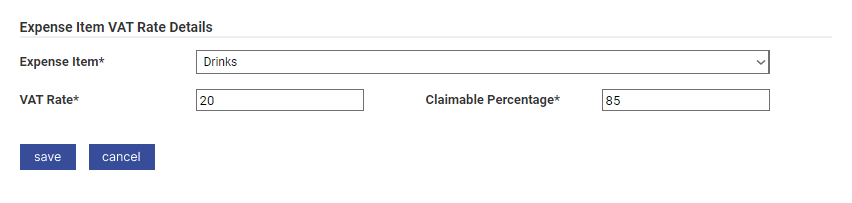

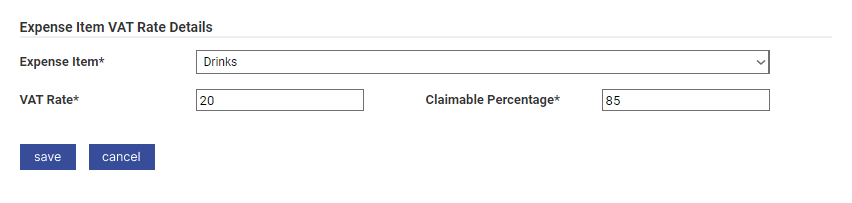

- Click New VAT Rate from the Page Options menu.

- Select the Expense Item that you want to specify the VAT rate for.

- Enter the VAT Rate (do not include the percentage symbol). The VAT Rate is the percentage of VAT that has been charged by the country for this Expense Item, for example French VAT on food is 20%.

- Enter the Claimable Percentage. The Claimable Percentage is the percentage to be reclaimed for each Expense Item through the Refund Scheme by HM Revenue & Customs. For example, there are instances where only 50% of the VAT value that was charged, is claimable.

- Click Save. This will return you to the Country Details page which will now list each of the existing VAT rates which have been created for this country.