Permissions

You will require an Access Role with the following permissions:

- Base Information (Expense Items)

This functionality works using the 'From' and 'To' journey fields to ensure that claimants are able to accurately claim their mileage, in accordance with their organisation's expense policy. This means that based upon the rules selected below, when a claimant enters their mileage, the deductions will be made automatically. The deductions are determined by the Home and Office locations that have been configured within the employee record.

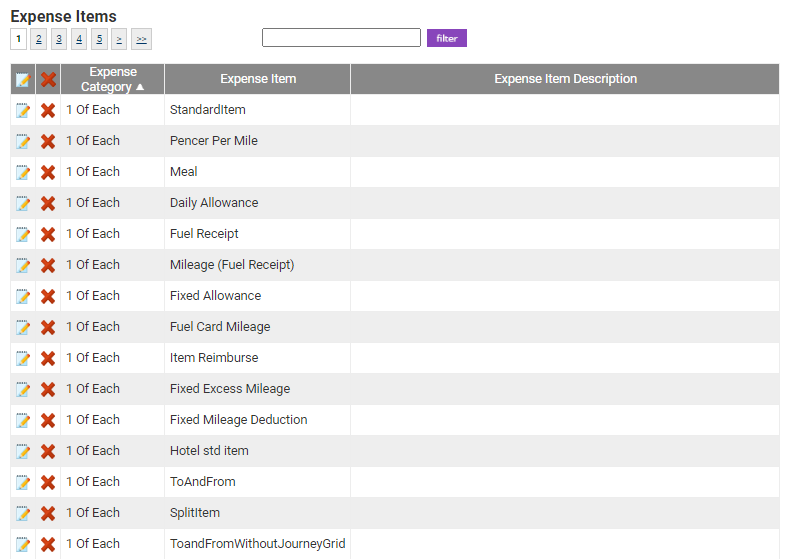

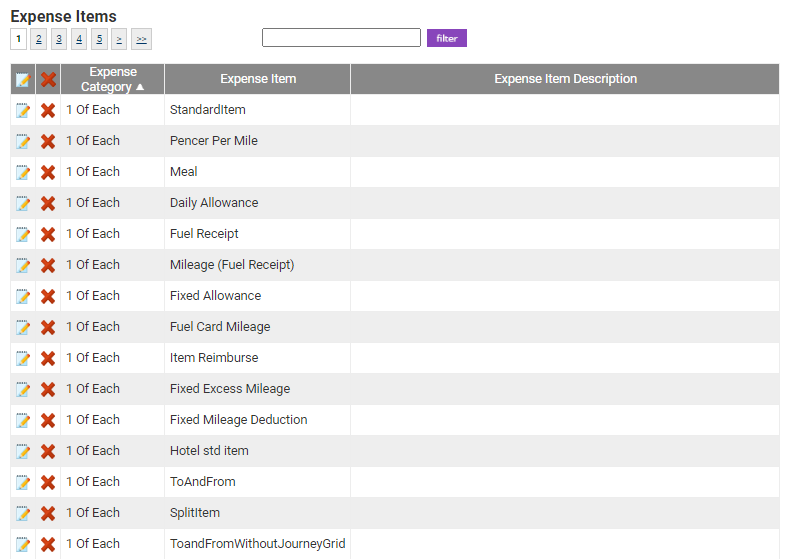

- Navigate from the homepage to Administrative Settings | Base Information | Expense Items. A list of existing expense items will be displayed.

- Create or edit an expense item that you want to apply the Home to Office rules for.

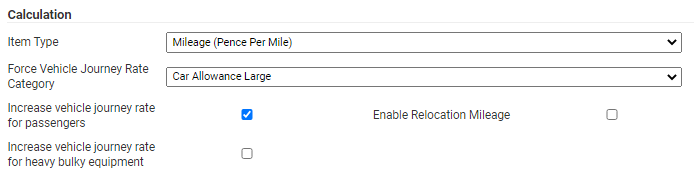

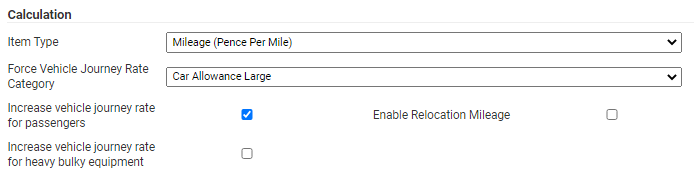

- From the 'General Details' tab, scroll down to the 'Calculation 'section and select Mileage (Pence Per Mile) from the Item Type list.

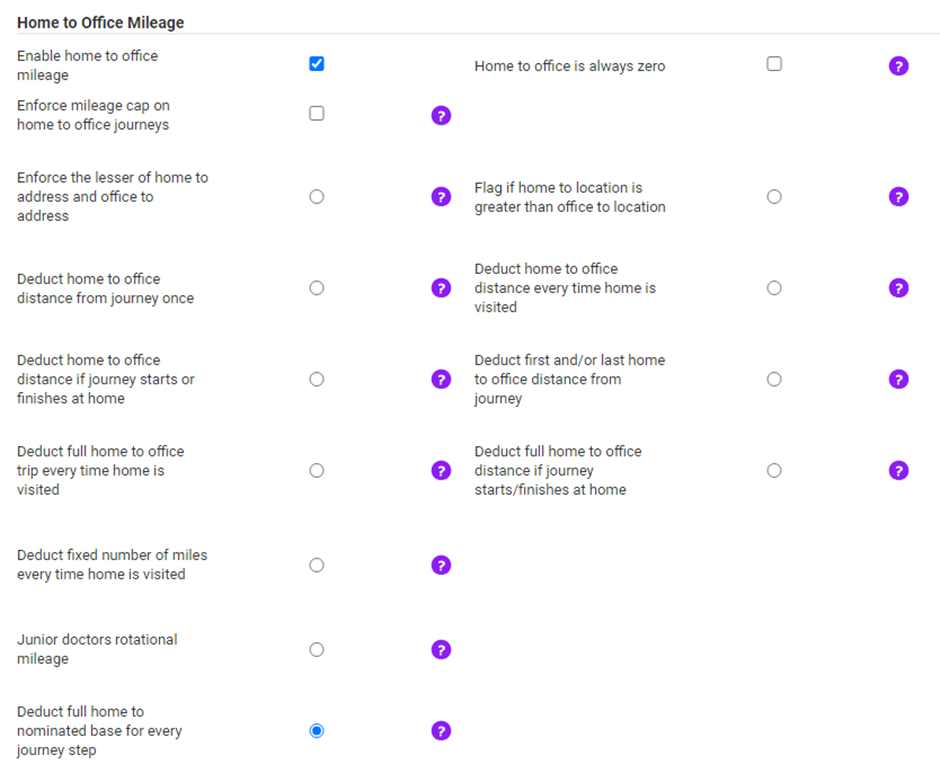

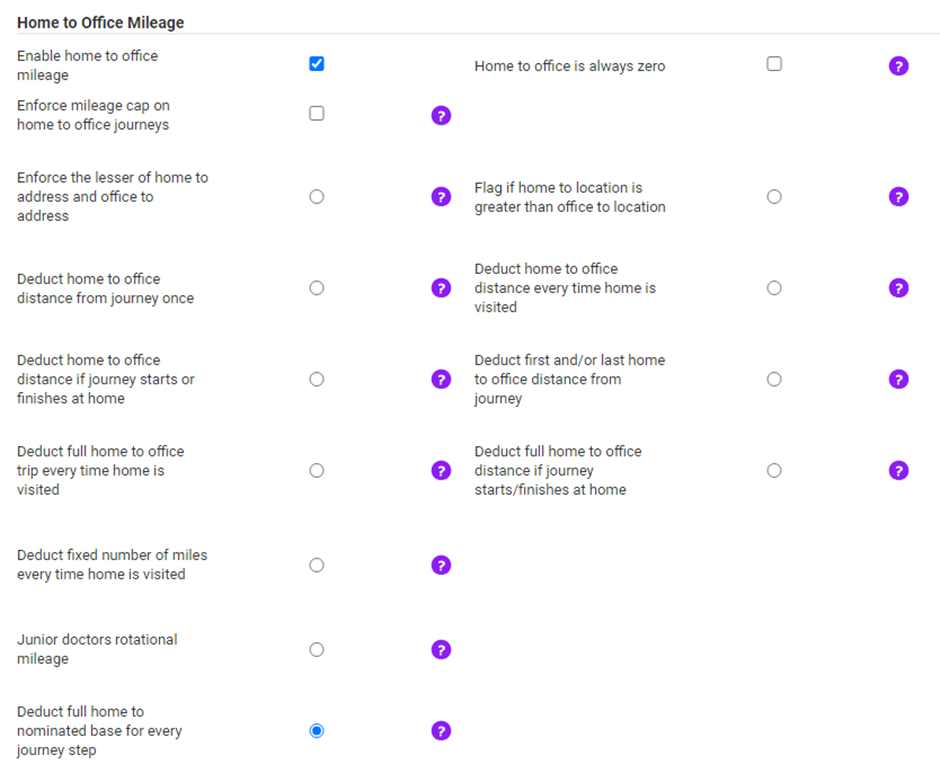

- Select the Enable Home to Office Mileage check box. This will then display a list of all of the available Home to Office deduction rules which you can apply to this mileage expense item.

A description and example for each Home to Office deduction is shown below:

Home to Office is always zero

If enabled, journeys between Home and Office will be set at zero reimbursable miles.

Note: This option must be used alongside another Home to Office deduction, but the zero (0) entitlement will take priority.

Enforce mileage cap on Home to Office journeys

Allows your organisation to cap the maximum number of reimbursable miles which can be claimed on a journey between Home or Office. Once this limit has been set, the reimbursable distance for a journey between Home and Office will be the lesser of the distance travelled and the limit which has been set.

Activating this option will display a new field where you will be required to enter the 'Maximum number of miles'.

Note: This option must be used alongside the 'Enforce the lesser of Home to address & Office to address' deduction rule. If the 'Home to Office is always zero' option is active, it will take priority over this option.

Enforce the lesser of Home to address & Office to address

If the journey starts from Home and the distance to the first location is greater than if you start your journey from the Office, then the miles payable will deduct the difference between the Home to the location and the Office to the location.

If the distance from the Office to the location is more than the Home to location then it will allow you to claim up to the Office distance.

Deduct Home to Office Distance from journey once

If the journey starts from Home to a location, but Home is visited again during that journey, the Home to Office distance will only be deducted once throughout the journey.

Deduct Home to Office Distance if journey starts or finishes at home

A deduction will be made if the journey starts or ends from the Home address. A deduction of 'x' miles for the Home to Office distance will be made when the start address is Home and a deduction of 'x' miles for the Office to Home distance made when the end address is Home.

Deduct Full Home to Office trip every time home is visited

A deduction of 'x' miles for the Home to Office distance will be made when the start address is Home and a deduction of 'x' miles for the Office to Home distance will be made when end address is Home. The calculation will continue deducting from adjacent steps until the whole distance has been deducted.

Flag if Home to location is greater than Office to location

A journey step's home to location distance is 'x' miles greater than the distance from the office to the location.

If the journey starts from home and the distance to the location is greater than if the journey started from the office, then a flag will highlight the difference between the home to location and office to location when saving the expense.

To learn about flags and how to create them, view Create a Flag Rule.

Note: The flag above is the 'Home to location greater' flag and is set to display immediately.

Deduct Home to Office distance every time Home is visited

A deduction of 'x' miles for your home to office distance will be made when the start address is home and a deduction of 'x' miles office to home distance will be made when end address is home. The deduction will be made every time your home address is visited in the journey.

Deduct first and/or last Home to Office Distance from journey

A deduction of 'x' miles for a Home to Office distance will be made when the start address is Home. A deduction of 'x' miles for the Office to Home distance made when the end address is Home. The deduction will be made on the first and last Home address found in the journey.

Deduct full home to office distance if journey starts/finishes at home

If the start address is Home, then a deduction of the claimant's full Home to Office distance will be applied. If the end address is Home, then a deduction of the claimant's full Office to Home distance will be applied.

Deduct fixed number of miles every time Home is visited

This option will deduct a fixed number of miles from each claim where a journey has visited home. Clicking this option will display the Number of miles to deduct field where you can specify the exact amount of miles that will be deducted every time Home is visited. Please note that this field is mandatory.

Junior doctors rotational mileage

If your journey is from 'Home' to 'Office' or 'Office' to 'Home', then a deduction will be made that is equal to the distance between 'Home' and your current work location. This will be paid at the Public Transport Rate. If your journey contains a destination other than 'Home' or 'Office', this journey is classed as an 'Official Journey'.

For an 'Official Journey', all mileage will be paid at your Vehicle Journey Rate, apart from the distance between your home and any other destination. This will be paid at the full Vehicle Journey Rate less the 'Public Transport Rate' for the distance between your current work (office) and the destination.

For more information on the junior doctor's rotational mileage rule, view Junior Doctor Rotational Mileage.

Tips:

- Multiple expense items can be created with different Home to Office mileage rules. Use the Item Role functionality to provide access to the appropriate claimants.

- Use Reports which return journey steps to understand the routes your claimants are traveling.

- Ensure all claimants have an accurate Home and Office address created within their employee record.

Deduct full home to nominated base for every journey step

This option is intended for employees who have a nominated base as well as a placement address or addresses where they are currently working, for example, junior doctors on rotation to different hospitals and clinics.

A deduction of ‘x’ miles for the home to the nominated base distance will be deducted from every journey step making up the claimed mileage.