Permissions

You will require an Access Role with the following permissions:

- Check & Pay

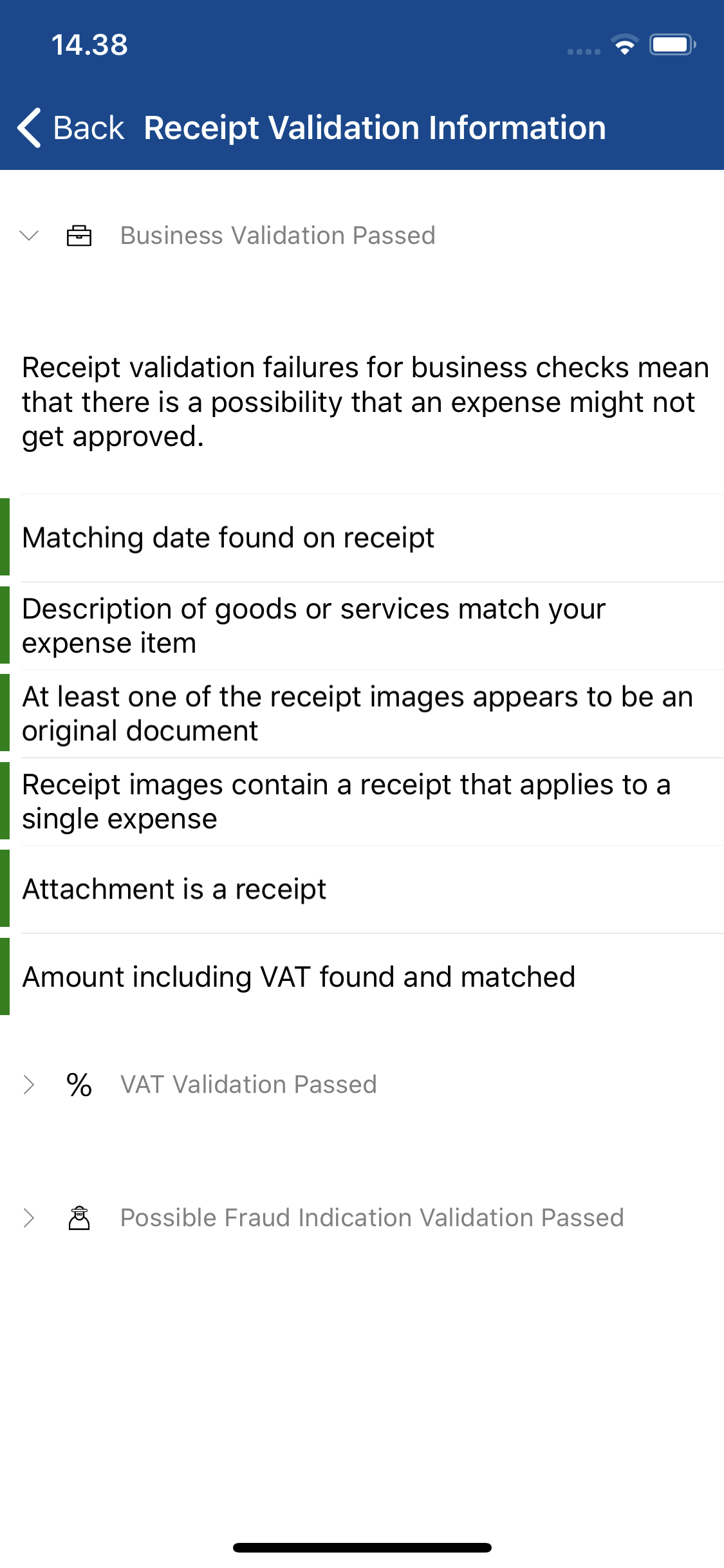

Receipt validation will occur based on the rules that have been set and agreed to by your organisation. Depending on the receipt type and what is required to be checked, a '16 Point Compliance Check' is performed.

As an approver, you have the ability to view validation results for your claimants, using the Check & Pay menu.

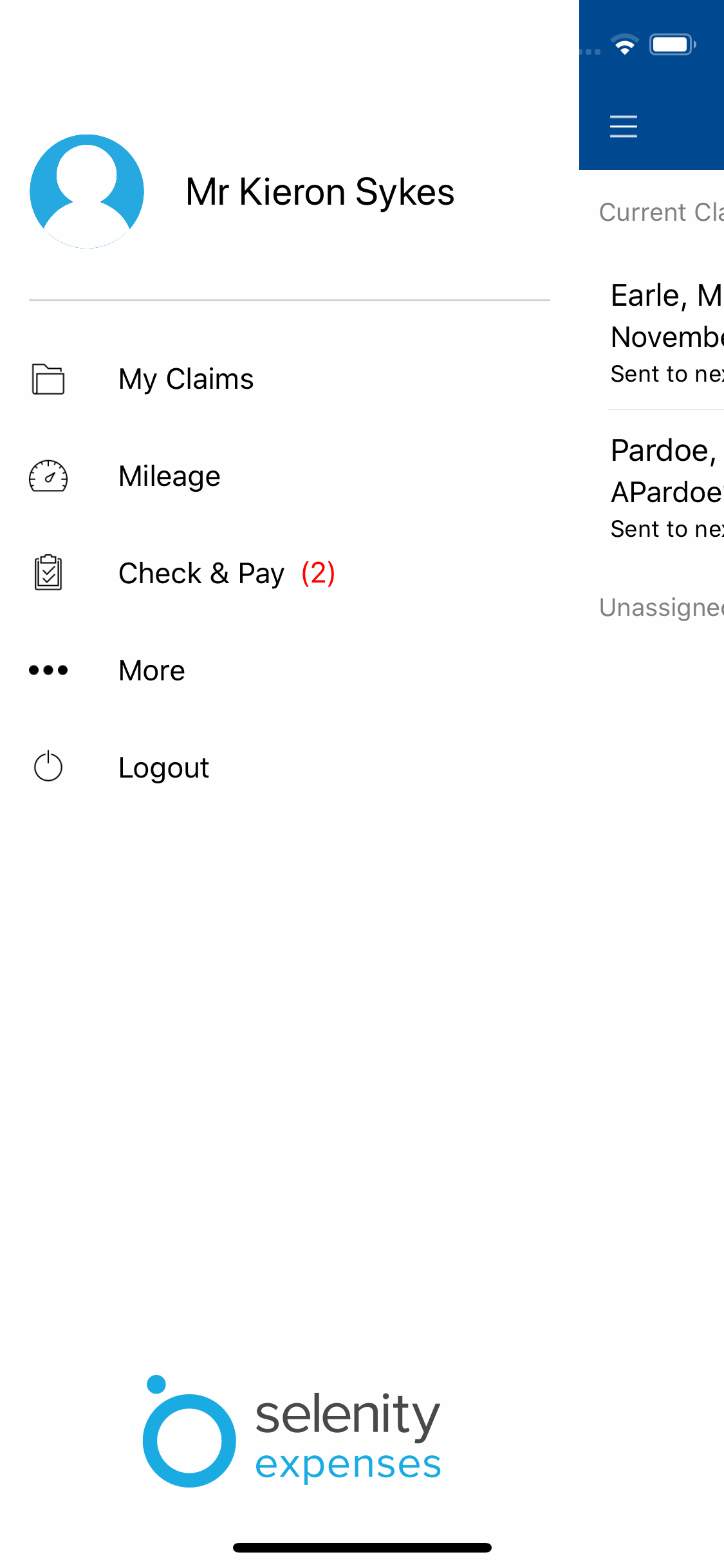

- Log into Expenses Mobile. Tap the hamburger menu

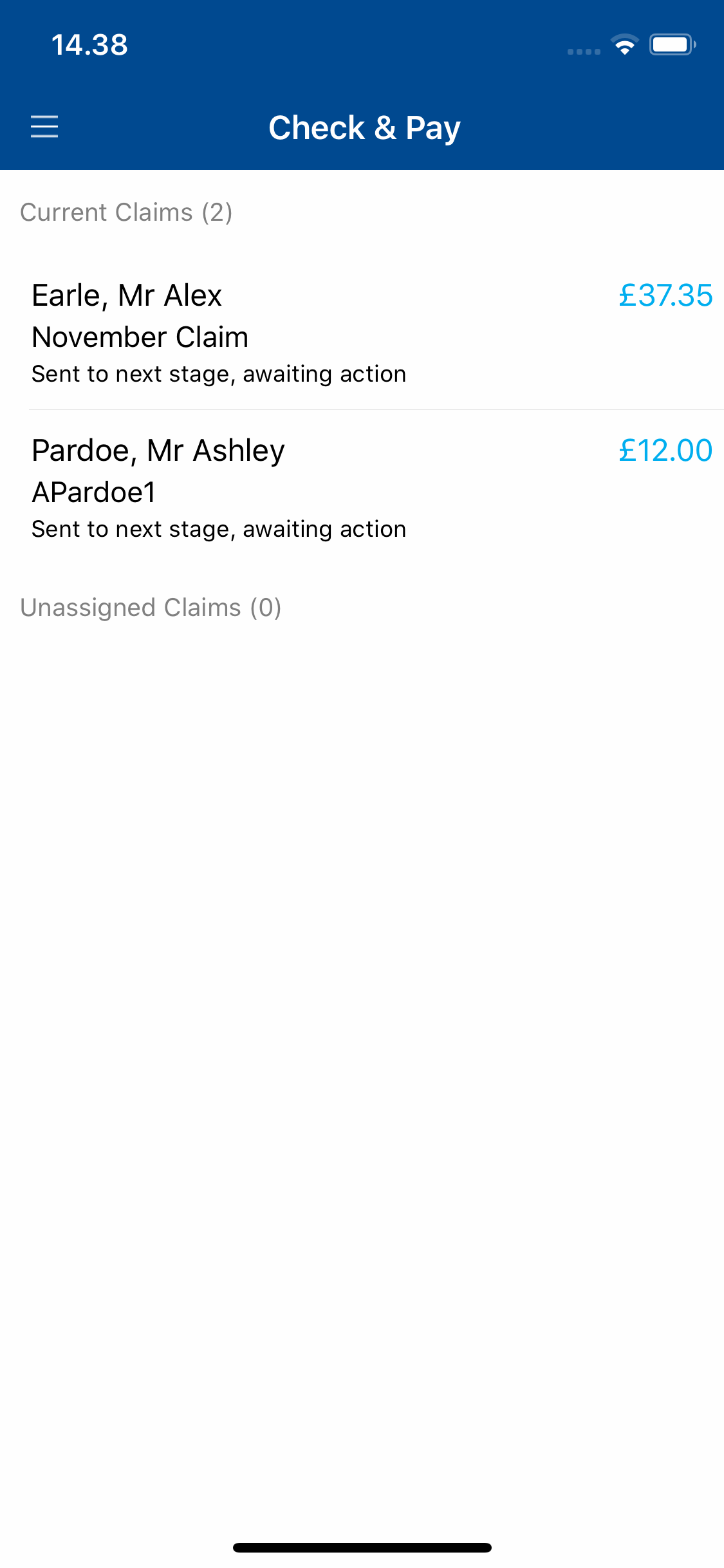

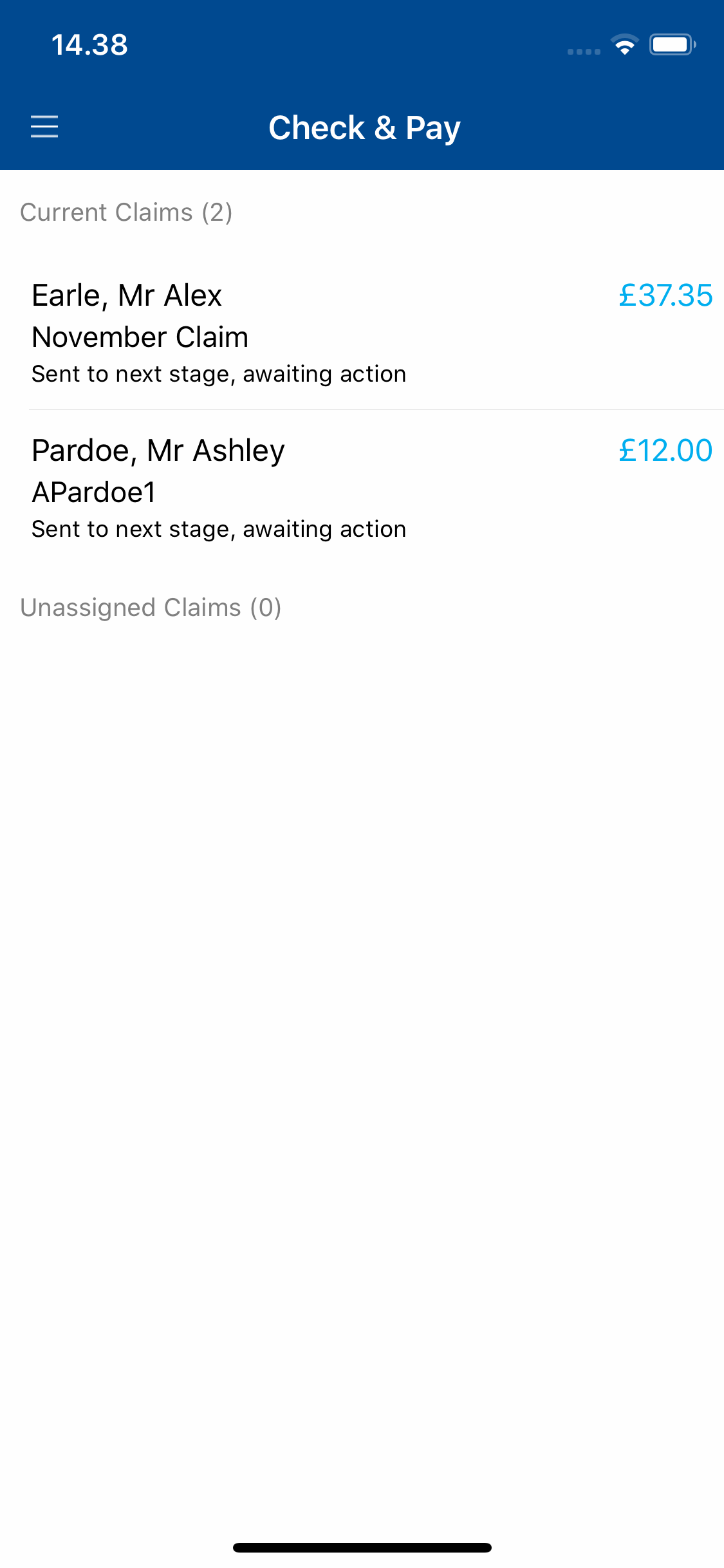

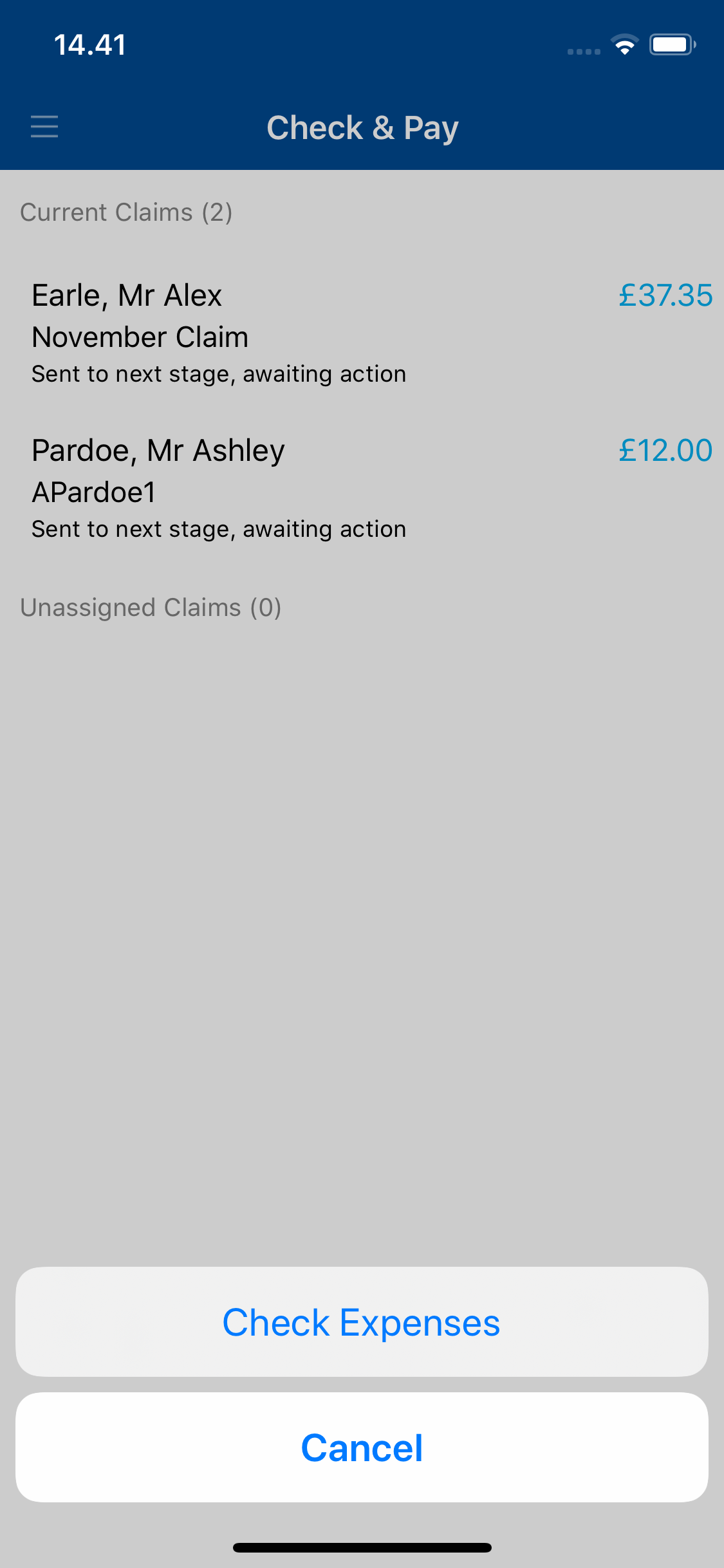

and then tap Check & Pay. This will display a list of claims which are awaiting your approval.

and then tap Check & Pay. This will display a list of claims which are awaiting your approval.

- If you are part of a team of approvers, claims which have progressed through to your team for approval will be displayed in the Unassigned Claims section. You must allocate a claim to yourself before you are able to process it. For details on how to do this, view Approve an Expense Claim.

- If you are part of a team of approvers, claims which have progressed through to your team for approval will be displayed in the Unassigned Claims section. You must allocate a claim to yourself before you are able to process it. For details on how to do this, view Approve an Expense Claim.

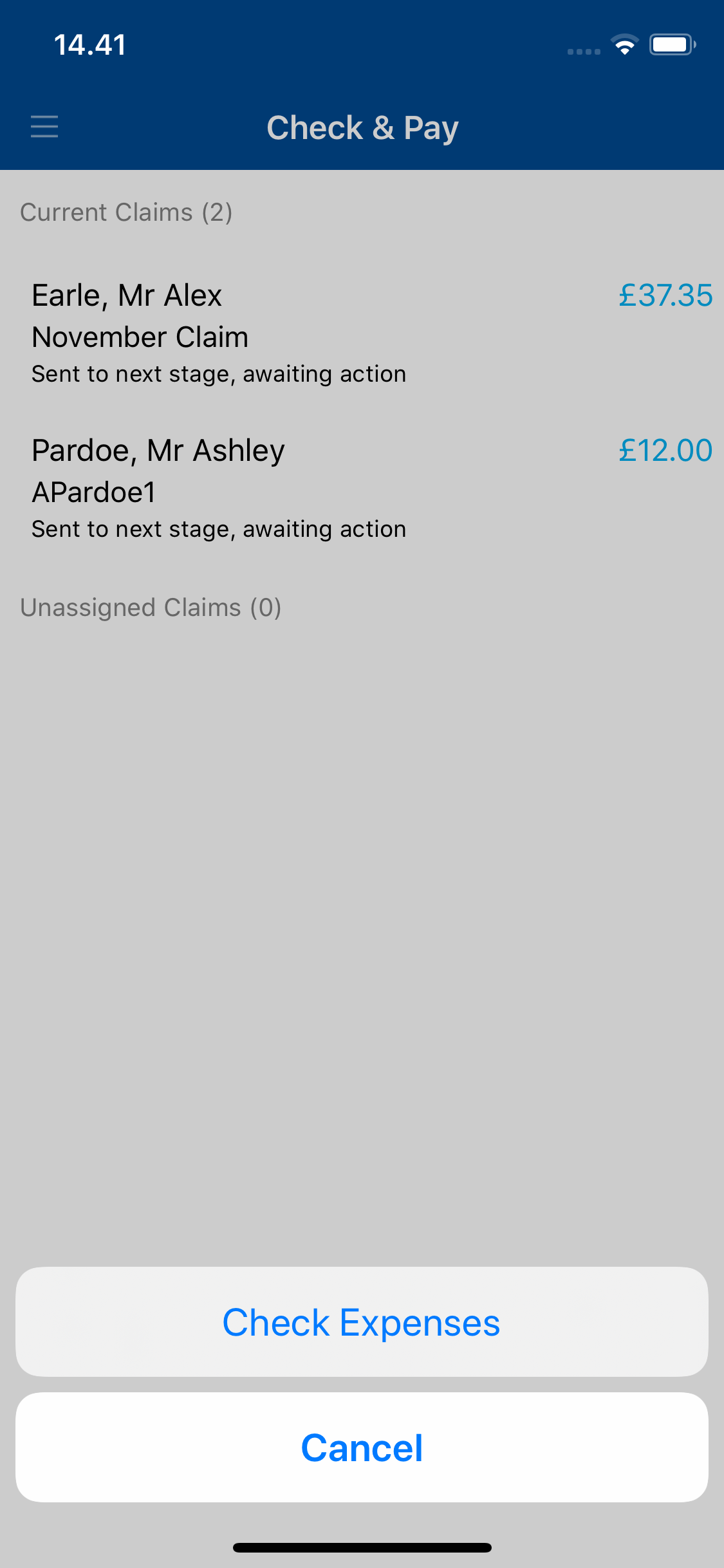

- Tap the claim that you want to view and then tap Check Expenses.

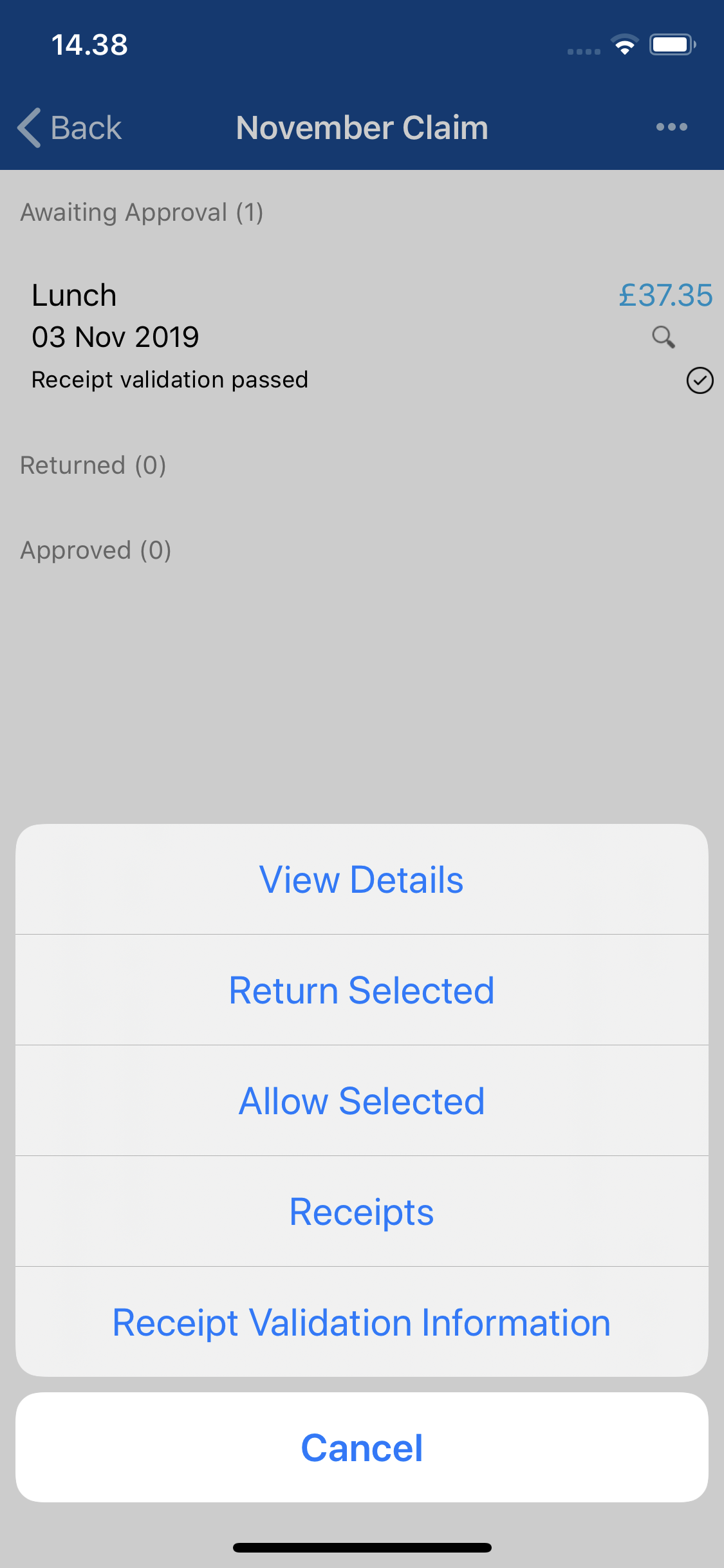

This will direct you to the Claim Details screen which lists each of the expense items on the claim. The current validation status of an expense will be shown with an icon, outlined below:Icon Further Information

Receipt validation is required on this expense.

If you can see this icon against a claimant's expense, it means that Expedite Validation will occur at a later stage of their Signoff Group.

Business Checks - Pass

VAT Checks - Pass

Validation status is set to 'Validated'.

Business Checks - Fail

VAT Checks - Pass or Fail

Validation status is set to 'Fail'.

Business Checks - Pass

VAT Checks - Fail

Validation status is set to 'Completed'. The expense will not be returned to the claimant despite the VAT fail.

Your organisation will not be able to claim back VAT on this item.

Business Checks - Pass

VAT Checks - Pass

After initial validation, the expense has been edited and therefore the results have been invalidated.

Business Checks - Fail

VAT Checks - Pass or Fail

After initial validation, the expense has been edited and therefore the results have been invalidated.

Business Checks - Pass

VAT Checks - Fail

After initial validation, the expense has been edited and therefore the results have been invalidated. - To view the receipt validation checks which were undertaken on an expense:

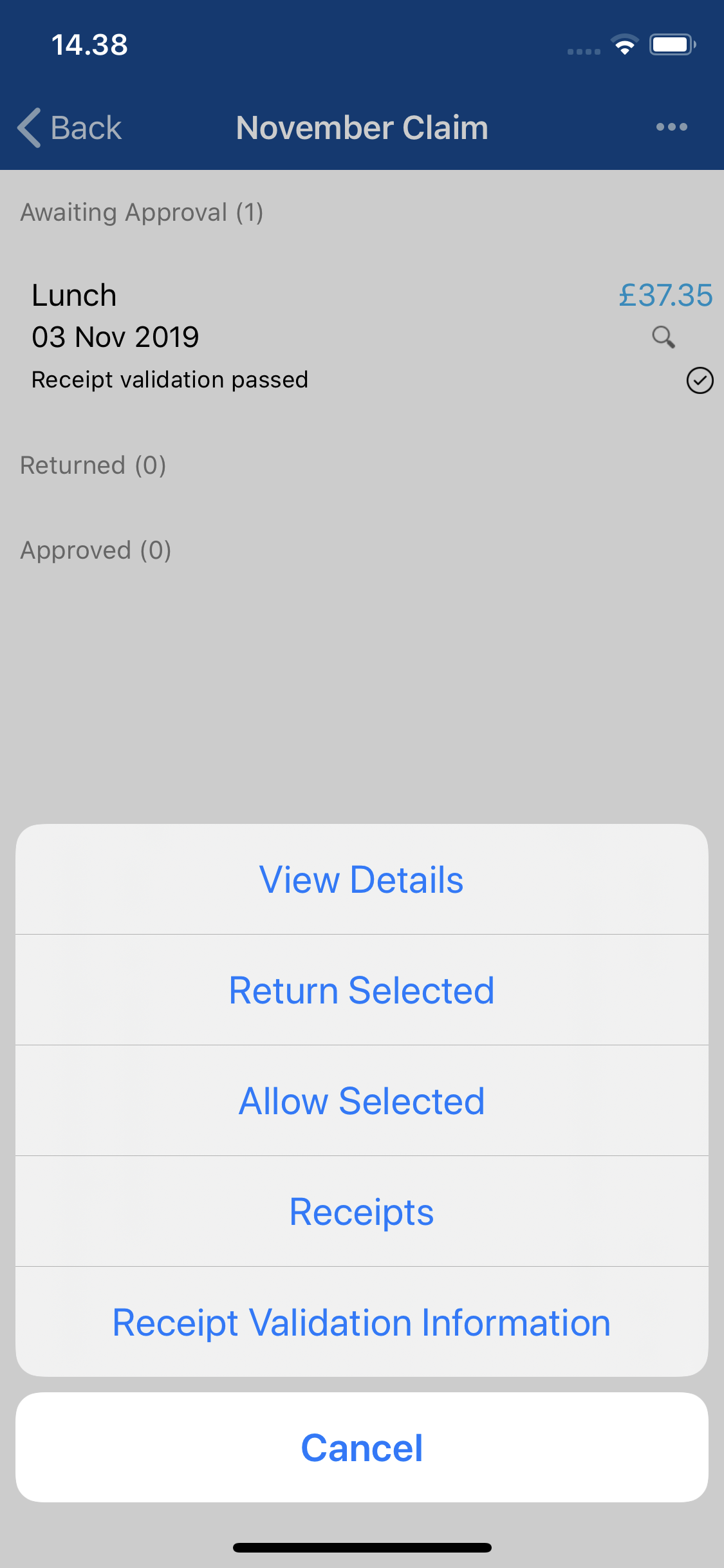

Platform Instruction iOS Tap on the expense and then tap Receipt Validation Information. Android Tap on the expense and then tap Receipt Validation Information.

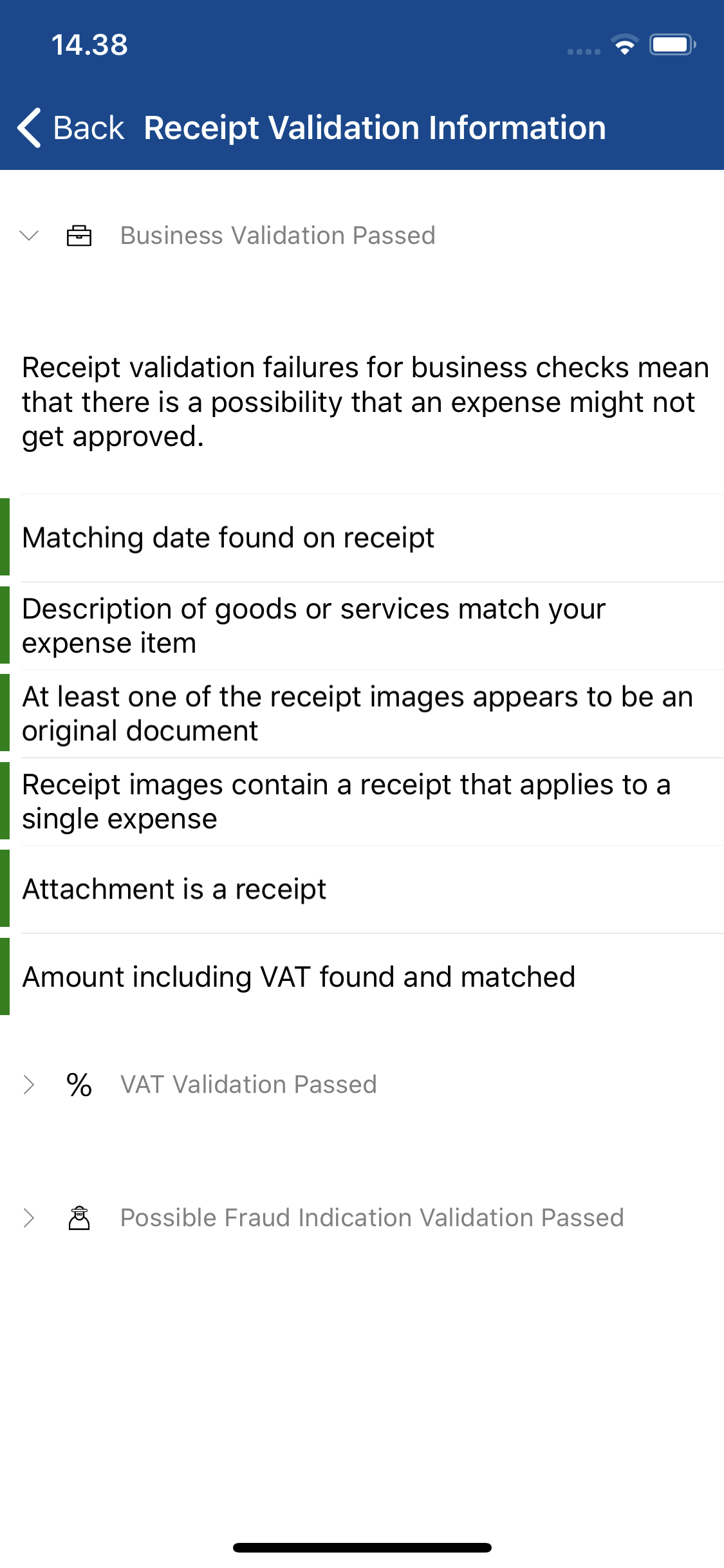

- Tap on the Business Validation, VAT Validation or Possible Fraud Indication headings to open or close that section. This will display each of the checks which were carried out against the receipt and expense. Comments which have been entered by the validation expert will display with a

icon.

icon.Validation Type Description Business Rule Validation The Business Rule checks will verify that the receipt matches what is being claimed on the expense. If any of these checks are failed, it will result in the expense being returned to the claimant for further information.

After an initial business rule fail, an expense can only be re-validated one more time. If it fails again, it will be marked as a 'Fail' and will progress to the next signoff stage with the rest of the claim.VAT Rule Validation The VAT Rule checks, if passed, allow your organisation to reclaim VAT in line with HMRC rules. If any of these checks are failed, VAT reclamation may not be possible for the expense, however, it can still be approved, in line with your organisation's expense policy. Possible Fraud Indicators This section will display any failed checks which indicate there is the possibility of fraudulent activity. In most cases, this will be entirely innocent, but it allows for trends to be easily identified across one or numerous claimants. The 3 fraud indicator checks are as follows: - Receipt is actually a receipt

- Receipt is a single receipt

- Receipt is an original.

Note: The fraud indicator check will not cause an expense to fail business or VAT checks, they are solely for the purpose of outlining any possibility. You will be able to bypass this if you think that no fraudulent activity has occurred.

Fraud indicators are generally accompanied by comments from the validation operator explaining why the expense has been flagged.- A red indicator will display against any checks which have failed receipt validation.

- A green indicator will display against any checks which have passed receipt validation.

- An amber indicator will display against any checks which have been identified as potential fraud indicator.

and then tap Check & Pay. This will display a list of claims which are awaiting your approval.

and then tap Check & Pay. This will display a list of claims which are awaiting your approval.

icon.

icon.